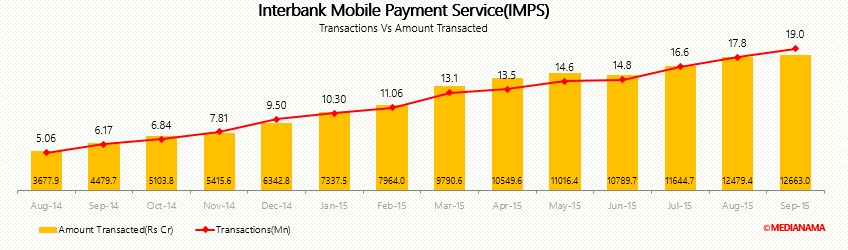

The Immediate Payment Service (IMPS) saw a 15.4% increase in the total transactions taking place between March and Apirl 2017. There was a 4.17% increase in total number of Mobile Money IDs (MMID), according to data published by the National Payments Corporation of India. The NPCI is the bank-owned organization that also runs the Unified Payments Interface (UPI), which doesn’t allow wallets. The IMPS transaction volumes grew on a monthly basis to 68.6 million (68,609,300 transactions) from 59.6 million transactions (59,637,992 transactions) while the amount transacted decreased 2% on a monthly basis to Rs 60,015 crore. The average transaction amount declined by 14.63% on a monthly basis to Rs 8,747.4 . Month-wise details Bank Status 53 commercial banks have signed up for IMPS.