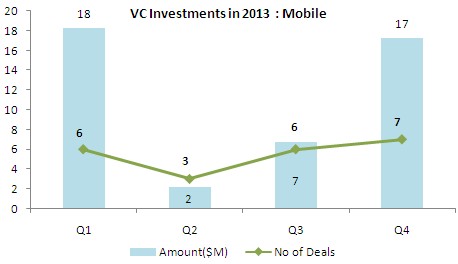

Updated below with quarterly information on investments, and most active VCs Some interesting pointers from Venture Intelligence's analysis on investments in 2013: VC firms reportedly invested about $805 million in 206 deals in India during 2013, around 18% lower than that in 2012, which saw 252 transactions worth $898 million. Some notes from their press release: - Early stage investments down: What is perhaps more worrying is that share of Early Stage investments went down to 68% of total, from 83% in 2012. Note that Venture Intelligence defines 'early stage' as first and second rounds of institutional investments into companies that are less than 5 years old and the investment size is less than $20 million. - Sub $5-M deals account for 69% of all investments - Regional distribution: Companies based in South India corner 41% of investments, followed by West (29%) and North (24%). Top cities: Bangalore with 49 investments and $214 million, Mumbai with 49 and $164 million, Delhi with 24 and $69 million, Gurgaon with 15 and $55 million, Chennai with 21 and $105 million. - 68 investments worth $237 million were made in Online Services companies, 29 investments worth $97 million in Enterprise Software (up from 21 investments worth $78 million in 2012), while 22 investments worth $46 million were made in Mobile VAS companies (surprisingly up from 18 investments worth $41 million in 2012). All in all, IT & ITES accounted for 130 investments worth around $404 million, around 50% of all investment in terms of…