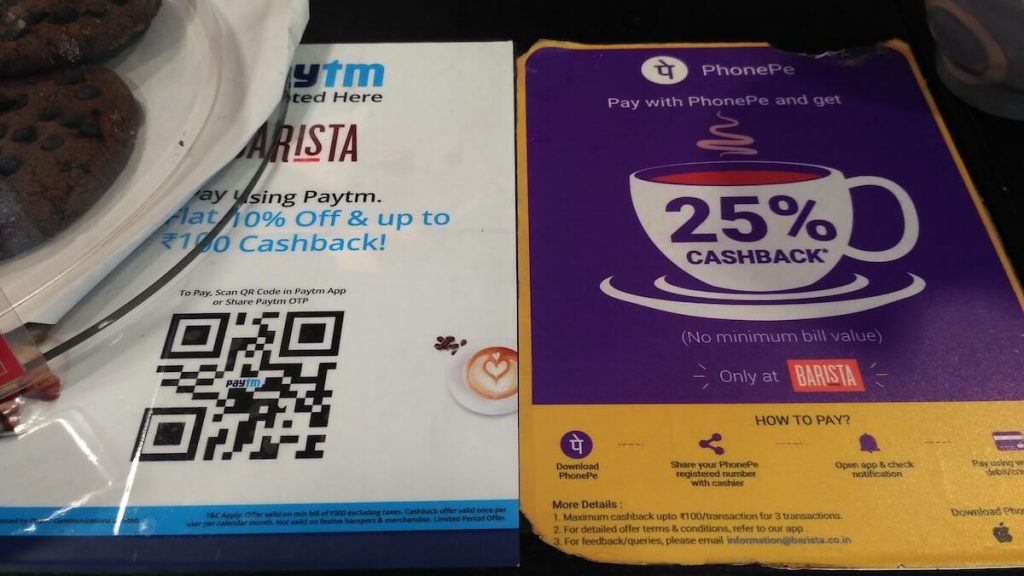

Editor's Update: Several senior payments industry sources have contested Paytm's claims privately to MediaNama, but none of them want to come on record about it. Following this, MediaNama also contacted NPCI, and they've declined to comment on company specific information. We would advise readers to exercise caution when taking these numbers into consideration. Earlier: Paytm clams to have processed 70 million UPI based merchant transactions out of the total 120 million transactions in the country in May 2019, reports Mint. The digital payments firm said that it was the “leader” in merchant-based UP transactions with 60% of the total market share, and seeing a 10% monthly growth rate in this segment. The company also claimed that 12 million offline merchants accepted payments via Paytm BHIM UPI. Paytm's senior VP Deepak Abbott told ET that the firm is planning to invest around Rs 200 crore to expand its retail merchant base, adding that Paytm plans to reach 25 million merchants from its current 10 million merchants by the end of 2019. This development means that Paytm’s competitors that include the likes of PhonePe, Mobikwik, Google Pay, PayPal and Razorpay among others have to fight for a tiny share of the pie. Here’s what some of them have been up to for establishing a foothold in UPI-based merchant payments: Paytm vs competitors PhonePe Flipkart owned PhonePe didn't share its numbers for recorded merchant payments, but told ET that merchant payments had increased multiple times since the beginning of this year. Yuvraj Singh Shekhawat,…