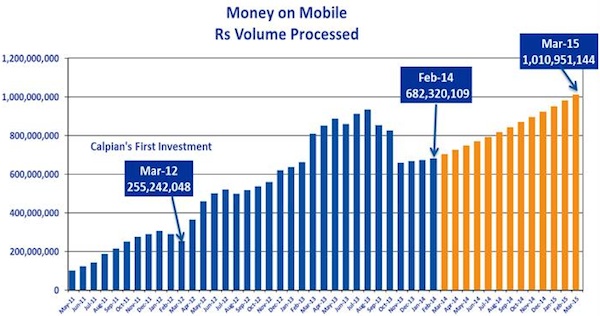

US-based electronic processing company Calpian Inc has raised $1 million from the Hall Financial group founder & chairman Craig Hall, who has committed a total investment of $5 million into the company. Calpian said it will be using this investment to fund its India-based mobile payment subsidiary Money-on-Mobile along with its US growth initiatives. Money on Mobile CEO Shashank Joshi mentions that Hall will also be advising the company on financial matters for three years. In addition to this, Calpian has also raised growth funding from a group of Silicon Valley executives led by Babu Vinod Sivadasan, Executive Vice President (Engineering) at Envestnet Asset Management last month. While the company didn't disclose the investment size, it termed this investment as a 'significant investment' and said this will be used to fund the growth of Money-On-Mobile. Remember that My Mobile Payments Ltd (MMPL) which operates the mobile money service Money On Mobile, had earlier mentioned plans of raising a total $50 million investment from Calpian and had applied for FIPB’s approval in the first week of August 2013. This includes an initial investment of $10 million and an expected $40 million investment later this year. In November 2013, FIPB had directed MMPL to raise Rs 58.91 crore (around $9.46 million then) through the automatic route. DPPL Investment: Note that this investment is different from Calpian's earlier indirect investment in MMPL. In April 2012, Calpian had invested in the company, by investing in a newly formed company DPPL (Digital Payments Processing Limited), which in turn had entered into a service agreement with MMPL. The company had then committed a $9.7 million cash investment and 6.1 million…