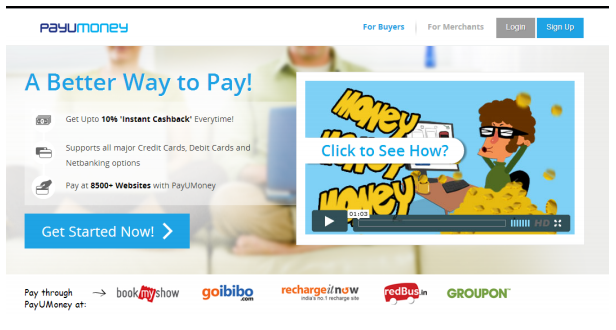

Payments company PayU India, which had started offering cashbacks to its wallet, appears to have removed it. In February, the company was offering 10% cashback for every transaction (up to a limit of Rs 50), but now it is merely offering discounts. At the time, to quote its own press release, "Available on 8500 websites, PayUMoney becomes the most widely available Wallet service in the Indian e-commerce Industry". We noticed that PayU wasn't mentioned in the Reserve Bank of India's recent update on semi-closed prepaid wallets, which mentions all the prepaid wallet services that were given a license till May 31, 2014. However, PayU's website makes a mention of a wallet on its pricing page, but the wallet is no longer being promoted on its homepage. Instead of cashbacks, the company now offers customers discounts, when shopping on merchant sites. PayU is not a merchant and doesn't have its own goods, so a closed wallet cannot be used for making third party purchases. It is worth noting that closed wallets do not require a license (explained below). If it was offering third-party purchases, then it needs a semi-closed prepaid wallet license. So did PayU even have a wallet when it began offering cashbacks? If not, how was it PayU offering cashbacks? Nitin Gupta, CEO at PayU, did not directly address these questions. In an emailed response, he asked us to try using the product, and "We call it cash back but we are giving upfront cash discount." However, this does not explain whether PayU was offering cashbacks to…