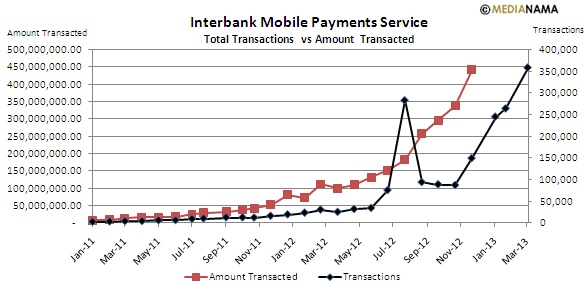

The Interbank Mobile Payment Service saw a growth of 35.66% in the total transactions taking place between February and March 2013, with a 3.36 % increase in total number of Mobile Money IDs (MMID) issued, according to data published by the National Payments Council of India. The transaction volumes increased substantially month on month from 263,926 to 358,038, even though the amount transacted increased by 36.35 % to Rs 136.73 crore. The average transaction amount increased by 0.51% to Rs 3819.10. Month-wise details: Banks Status 56 banks have so far signed up for IMPS, with 7 banks including Catholic Syrian Bank , IDBI Bank, Indian Overseas Bank, Andhra Bank, State Bank of Bikaner and Jaipur, Bank of Baroda and Dhanlaxmi Bank in soft launch. Among banks, ICICI Bank issued the maximum numbers of MMIDs at 174.72 lakh followed by AxisBank with 82.45 lakh, SBI Bank with 56.80 lakh MMIDs, Indian Bank with 44.95 lakh and Kotak Mahindra Bank with 21.74 lakh MMIDs. This means that the top 5 banks out of 56 account for as many as 87% of the total number of MMIDs. While it is expected that the more the MMIDs, the more the likelihood that P2P transactions will take place, the figures continue to be dismal. The NPCI is taking other steps to promote the service as well, including the introduction of a universal USSD code to access the service. We’d like to reiterate that all partner Banks are still not promoting the IMPS at a level necessary for its growth. Related:…