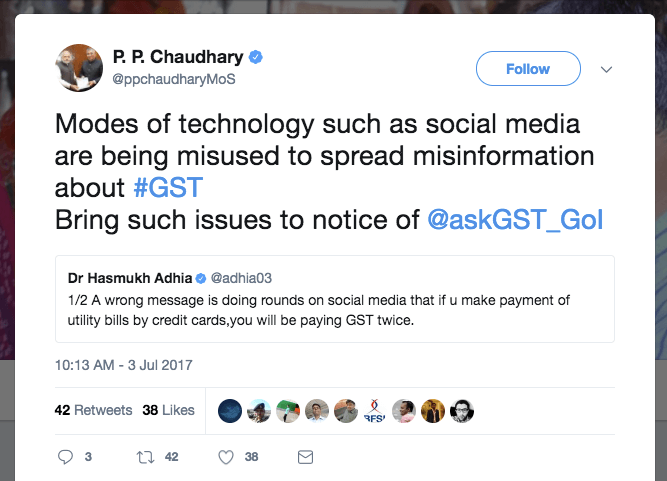

The Ministry of Finance issued an appeal to citizens to not circulate "wrong messages" on social media: it appears that messages were circulating falsely suggesting that temples are subject to Goods and Services Tax (GST), while Churches and Mosques are exempt. https://twitter.com/FinMinIndia/status/881894212286922753 Appeal to people not to start circulating wrong messages on social media as no distinction is made in the GST Law on any provision based on religion. There are some messages going around in the social media stating that the temple trusts have to pay the GST while the churches and mosques are exempt. This is completely untrue because no distinction is made in the GST Law on any provision based on religion. We request to people not to start circulating such wrong messages on social media. Revenue Secretary Dr Hasmukh Adhia also took to Twitter to point out users won't be charged GST twice if they pay for utility bills using credit cards, saying "A wrong message is doing rounds on social media that if u make payment of utility bills by credit cards, you will be paying GST twice. This is completely untrue. Please do not recirculate such message without checking it with authority." (source: this and this) MediaNama's take 1. Those in power need to behave more responsibly: This appears to have taken some time to gather momentum, but perhaps it would have helped if a Member of Parliament hadn't posted a statement. https://twitter.com/Swamy39/status/877558464297394176 Such a statement gives the MP plausible deniability, but it also…