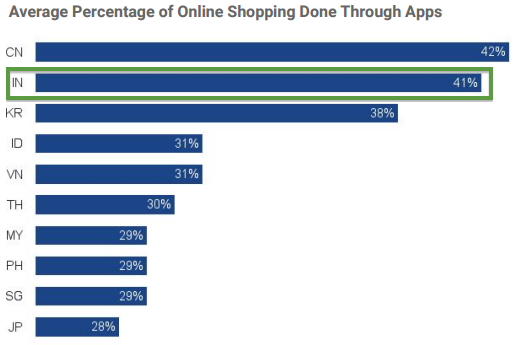

Google has released a "Mobile App Marketing Insights: Asia report", surveying smartphone users and their app behaviour across 10 Asian countries including India, Philippines, Thailand, Malaysia, Vietnam, Singapore, Indonesia, Korea, Japan and China. The release claims that the study surveyed 10,000 users. Top highlights from report: Smartphone users in most Asian countries spend nearly equal amount of time on mobile apps and websites Users from developed countries in Asia use higher number of apps while emerging countries have fewer apps Emerging countries engage more with apps on a daily basis Searching on app stores is one of the most common ways users discover apps. Users in Asia consider reviews, ratings, app size and cost before installing a new app Gaming apps is the most popular category of apps installed and uninstalled by respondents surveyed in Asia More than half the respondents were comfortable with making purchases on apps Most users consume free content in Asia while 20% of the respondents pay subscription or make one-off payments on apps Nearly two-thirds of the respondents were comfortable making purchases within apps while gamers are more comfortable making in-app payments More than 25% of the users shop online through mobile apps Predominantly users in China, India and Indonesia use mobile apps instead of websites for price comparison The net gain of apps is higher in emerging countries than in developed countries Users from Asia have their notifications turned off for nearly 50% of the apps while they are also more likely to revisit old apps…