By Rajiv Kr. Choudhry, SpicyIP

This post deals with two issues in separate parts. Part I deals with the practical problem presented by some, and in my view, incorrect orders of the Delhi High Court. Part II deals with a possible solution to the problem.

Last year we had written about the order of Delhi High Court directing ad-interim payments to be made by Micromax Informatics to Telefonaktiebolaget LM Ericsson. This decision made the basis on which further orders related to different parties were given. For example, the Intex order discusses the same 12 November order of Micromax, and lays down a similar set of interim rates. Similarly, for Gionee, a recent order of 19th October, 2015. In all these orders directing interim measures, a percentage is applied to the “net selling price.” This net selling price is the price charged to a distributor.

In my view, this is an overreach as explained below, as net selling price includes many parts that are not technical: simply put, they are taxes, duties, marketing etc. and have no role to play in determining a value of the patent because there is no relationship between taxes, etc. and patents.

The Net Selling Price is in respect to each company product sold (by the company or any of its affiliates); the Selling Price charged by the company or its affiliate for such company product unless such sale has not been made on arm’s length basis (in which case the net selling price will be the selling price which the seller would realize from an unrelated buyer in an arm’s-length sale of an equivalent product in an equivalent quantity and at the equivalent time and place as such sale). Selling price shall mean the selling price charged by the company for the product in the form in which it is sold (whether or not assembled) and without excluding therefrom any components or sub-assemblies thereof (gross price) less 3% representing a deduction which shall cover usual trade discounts actually allowed to unrelated buyers on a regular basis, actual packing costs actual costs of insurance and transportation etc.

Some of our readers may argue that if this rationale is applied, the industry will severely limit the value of the patent. My response is simple: “Royalty for patented feature – should be driven by the value of that patent” or put in other words – Customers should purchase the product because of the value brought in by the patent. An example would help here. In the compulsory license issued by the patent office, taxes, duties, factory etc. were included and a 6% figure applied, because the end product (pharmaceutical product) was directly related to the patent, i.e. the patent drove the demand for the product. In the case of a telecommunication patent, there are studies showing that there are more than 250,000 patents in a smartphone.

The telecommunications industry, and the mobile phone industry in India is a net importing industry and would continue to remain one until we are able to set up fabs for producing semiconductor chips. When we use a product by the domestic manufacturers, it should be kept in mind that the entire product is imported in either SKD/CKD kits. There is no manufacturing, just assembly. So far it has been the case that complete boxed units are imported.

On import, several taxes including customs duty, countervailing duty, and special additional duties are levied on something called as Cost + Insurance + Freight or CIF. These duties are at least 12.5%. See duty structure at labnol.org. The Government of India provides incentives to locally assemble to encourage manufacturing – but even after including these incentives, the duty is 12.5% on CIF. It is to be noted here that Insurance and Freight are not related to patents. On this value (CIF + 12.5% customs duty), states levy a Value Added Tax ranging from 5-15% but majority of them peg it at 12.5%.

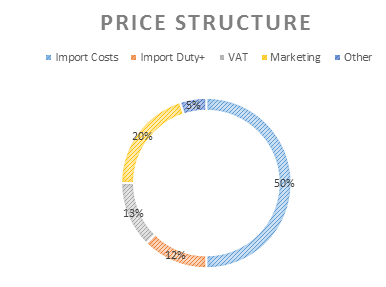

25% government duties is a clear figure that is unrelated to patents and in my view there can be no quarrel that interim royalty for patents should not be based on a percentage on government taxes and duties. Additionally, there are marketing costs and distributor margins that take another 20% that have no relation with the patents. Then there are insurance and freight costs (3%) and these should not be capped but be at actuals. Others include battery, charger, certifications, costs and these are also 5%.

If I take the above logic to the logical extreme, taxation is a sovereign function and a patent owner cannot override the sovereign. In this regard, this is a constitutional law issue as well.

Readers may or may not agree with the exact figures, but the concept that royalty can’t be imposed on taxes, duties, marketing expenses, distributor margins, etc. should be acceptable and I would love to hear contrary views.

*

Part II

What is an appropriate base for royalty on SEPs?

Last year, Florian Mueller had publicly put out a post on why Ericsson charges royalty on end product. See fosspatents.com. I use the same slides but for a different context. In this figure, Tomas Dannelind describes the value chain for SEPs. The standards are taken together to a platform designer. Then the concept in the standard is hardcoded at the chip level and a chipset is produced. The chipset goes to the ODM, who sells a final product to a brand owner.

This, in my view, is an admission that all standard essential patents are implicated at the chipset level as if they were not, then there was no point in including them in the presentation. Further, the slide discusses the exposure increase and decrease to Ericsson if licensed at chipset level or product brand owner level.

Critics may argue that it the communications functionality provided by the SEPs, and that is entitled to full value of device. As discussed above, royalty can only be imposed on cost only. And when discussing functionality provided by the chipset, the value is limited to the value of the chipset only. These critics, are stuck in the past when the value of the mobile phone (90s) was in the chipset only. Other parts were ancillary to the communications part. Today, the chipset/communications part is ancillary to the other parts such as screen, memory, camera, etc. And hence arguments like- ‘If you click a picture on phone, and send to friends, you implicate the full value of device with communication part being of utmost important’ – are incorrect. One, because royalty has already been given to the camera module provider, and two, there is no role that communications chip play in taking the picture.

Hence, the proper base for application of royalty for valid, essential and infringed patents is a chipset, and accordingly, royalty should be applied at the chipset level only.

Read the original post here.

Copyright © 2015 SpicyIP. This article has been crossposted with permission from SpicyIP.

Top Image Credit: