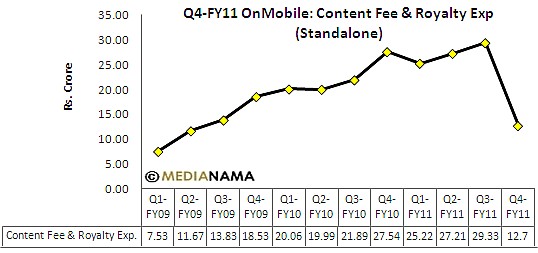

OnMobile Global reported a decline in revenues in the quarter ended 31st March 2011, owing to "change in contractual scope involving content management responsibilities in one of its major customers." This is probably the reason why content fee and royalty expenses for the company also saw a 53.09% decline quarter-on-quarter and 50.09% year-on-year, at Rs 13.76 crore. We've not been able to confirm this, but we've heard rumors that Vodafone was looking to do direct deals with music labels, bypassing platform companies. On the conference call, OnMobile CFO Rajesh Moorti explained: "In one of the large customers, there is a change in the content management responsibilities, and that has had an impact on the revenue. Without this adjustment, our revenue would have been more or less flat quarter on quarter, and our EBITDA would have been 21%, as against 23% in the quarter before. For modelling purposes, you can consider a recurring revenue adjustment of roughly around Rs. 10 crore going forward." We'll have more from the concall soon. Annual Results For the fiscal year 2010-2011 (FY11), on a consolidated level, OnMobile's total revenues increased by 18.2% at Rs 537.21 crore, compared with last year's revenues of Rs 454.40 crore. Its net profit saw a jump of 104.7% at Rs 86.68 crore, from Rs 42.35 crore that it registered, last fiscal. On a standalone basis, OnMobile registered a net profit of Rs 91.64 crore, an increase of 73.2% over previous year's profit of Rs 52.91 crore. Its total revenue also…