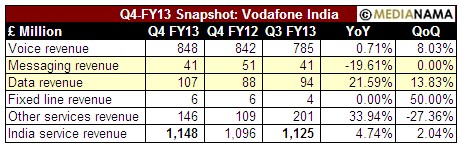

Data revolution has started in India: Vodafone India has reported a total data revenues of Rs 3,175 crore for the financial year ending March 31, 2013 (FY13), registering a 19.9% growth from Rs 2,640 crore data revenues in FY12. The numbers: - 37.3 million total data customers, up 12.7% from 33.1 million customers last quarter. - 3.3 million 3G customers, up 0.8 million from 2.5 million 3G customers last quarter. - 34 million 2G customers, up 3.4 million from 30.6 million 2G customers last quarter. - Data now contributes to 7% of the company's total service revenues in FY13. - Vodafone India claims to have covered 18% of the data population as of March 2013. Vodafone defines data users as subscribers who have consumed greater than zero KB data on its GPRS or 3G networks. Data & Messaging revenues: For the quarter ending March 31, 2012, Vodafone saw a total data revenue of £107 million (around Rs 898.5 crore), up 13.8% from £94 million (Rs 788.4 crore) in the previous quarter and up 21.6% from from £88 million (Rs 737.6 crore) in the same quarter last year. The company however mentions a 29% growth in data revenues at constant exchange rates in its earnings presentation. Vodafone India's Messaging revenues was £41 million (Rs 343.89 crore) for the quarter, flat sequentially from £41 million (Rs 343.89 crore) in the previous quarter but down 19.6% from £51 million (Rs 428.2 crore) in the same quarter last year. For the year FY13, the messaging revenues were £156 million (Rs 1309.9 crore), down 24.6% from £207 million (Rs 1738.2 crore) in FY12. Data Browsing…