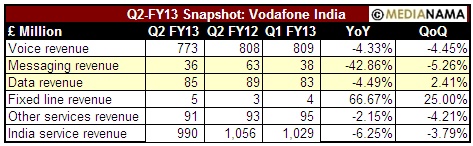

Update: Updated with highlights from the H1FY13 results. Vodafone India reported data revenue of GBP 85 million for the quarter ended 30th September 2012 (Q2-FY13), up 2.41% quarter on quarter, and down 4.49% year on year. Messaging revenue for the company was GBP 36 million, down 5.26% quarter on quarter, and an alarming 42.86% year on year. The company, as of 30th September 2012 reported 32 million active data customers, of which approximately 2.1 million were 3G data customers. Vodafone's India revenue declined to GBP 990 million for the quarter, down 4.45% quarter on quarter, and 4.33% year on year. Q2 is typically the toughest quarter for telecom companies in India. Note that the decline in voice revenues should also be seen in conjunction with the decline in voice minutes (down to 144,012 million from 148,042 million last quarter), and a decline in customer base (down 1.04 million to 152,665 million; more data in our datasheet below). According to Vodafone, "Customer growth in Q2 slowed as customer acquisition costs were reduced, lowering the level of multiple SIM activation, which had a positive effect on margin. At the same time, the anniversary of the introduction of SMS termination fees in Q2 of the prior financial year has also impacted second quarter growth"..."There was also a lower rate of growth at Indus Towers following a slow down in tenancies from new entrants and a change in the pricing structure for some existing customers." Data & Messaging The combination of data and messaging, as indicated in the…