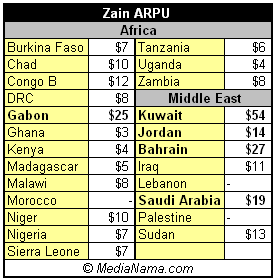

The two Indian PSUs BSNL and MTNL may be joining a consortium that is buying a 46% stake in the Kuwait-based Mobile Telecommunications Company K.S.C., also known as Zain Telecom. However, the telcos have issued a formal clarification saying the decision to participate has not yet been made. Zain has been trying to sell its African operations, which Indian telecom major Reliance Communications was believed to be interested in. According to Business Line, the consortium is led by New Delhi based Vavasi Group's Telegence division and Malaysian magnate Syed Mokhtar al-Bukhary. Information on Vavasi is limited; it is not known who its promoters are. Its site vaguely puts it as having a division in the telecom infrastructure and service segment. A Kuwait News Agency report on Zain's site claims the deal has already been concluded for $14 billion (Business Line puts it at $13.7 billion) and will take four months to be legally completed. It reports the group's Deputy Chairman for Industrial Activity and Information Technology Bader Al-Kharafi as saying the per share value would be two Kuwaiti dinars. It also reports that the Asian consortium includes an Indian private company; again an unknown entity. These developments should be viewed in the context of a potential merger between Bharti Airtel and MTN, which is a Zain competitor in Africa. MTN is yet to conclude its $24 billion merger withBharti Airtel, exclusive negotiations are still ongoing. The new deadline for the talks is now the 30th of September. Zain's Aim, BSNL's Gain Zain operates in 23 countries in Middle East and Africa,…