The Competition Commission of India (CCI) on March 3 dismissed an antitrust complaint filed by the All India Online Vendors Association (AIOVA) against Amazon stating that AIOVA did not provide sufficient material for CCI to form a prima facie view in the matter. AIOVA is an association comprising more than 2000 online sellers across the country.

The information filed by the complainant “contains allegations that are devoid of admissible/requisite evidence. Thus, the Information filed lacks actionable material for further examination under the Act,” CCI noted.

CCI, however, is still investigating Amazon and Flipkart based on a complaint filed by the Delhi Vyapar Mahasangh (DVM), a group of MSME (Micro, Small and Medium Enterprises) smartphone traders.

What were AIOVA’s allegations against Amazon?

In its complaint filed in August 2020, AIOVA alleged that Amazon Seller Services entered into anti-competitive arrangements with Amazon Wholesale, Amazon Retail, Cloudtail, Prione Business Services, which resulted in deep discounting and lack of platform neutrality through the following practices:

- Amazon Wholesale sells products at a loss to Amazon Retail and Cloudtail driving independent sellers out of the marketplace: AIOVA alleged that Amazon’s business-to-business (B2B) arm, Amazon Wholesale, buys goods in large quantities directly from manufacturers, and then sells them at a loss, unlike other wholesalers, who would sell at a profit, to Amazon Retail and Cloudtail, both of which are sellers on the Amazon marketplace platform. Amazon Retail and Cloudtail, in turn, sell their products to consumers at massive discounts, which other sellers selling similar categories of goods cannot match. This anti-competitive arrangement amongst Amazon and its affiliate entities is driving existing and independent sellers out of the marketplace, resulting in the foreclosure of competition, AIOVA submitted. AIOVA also submitted financial results of Amazon Wholesale and Amazon Retail to support its allegation that these companies give deep discounts, according to which, Amazon Wholesale suffered a loss of approximately ₹140.80 crores in 2019 and ₹131.40 crores in 2018, whereas Amazon Retail suffered a loss of approximately ₹127.40 crores in 2019 and ₹6.40 crores in 2018.

- Higher platform fees for independent sellers: AIOVA alleged that Amazon charges independent sellers higher platform fees compared to what it charges Amazon Retail and Cloudtail. AIOVA further alleged that this practice funds the discounts of Amazon-affiliated sellers while inflating the prices of the goods sold by independent sellers. Based on financial statements of Cloudtail, AIOVA submitted that the platform fees paid by Cloudtail to Amazon for the sale of goods comprising consumer electronics, apparel, household items, consumer products, etc., worth approximately ₹8,816 crores, is approximately ₹561 crores, which is about 6.3%, whereas the platform fee calculated on Amazon’s website for independent sellers using the automated fee calculator was about 28.1% for electronics, 17.6% for groceries, and 28.6% for apparel.

- Misusing data of independent sellers to build private labels: AIOVA said that Amazon works in collusion with Amazon Retail and Cloudtail to use the data of successful manufacturers and sellers on its marketplace to float private labels and sell them at massive discounts to underpin competition. They exploit competitors’ data to build their product without having to invest in the time and resources, AIOVA submitted. Furthermore, these private labels get a better placement on the Amazon marketplace, which is a paid service for the independent sellers, AIOVA added.

- Working in collusion with Cloudtail and Amazon Retail: AIOVA submitted that Amazon Retail and Cloudtail work on a two-fold business model wherein, firstly, they act as sellers and sell goods of third party brands under the name “Amazon Pantry,” and secondly, they also sell private labels under various categories of products, such as “Vedaka”, “Presto,” “Solimo”, etc. AIOVA alleged that Amazon and the two sellers “in collusion” have been offering massive discounts for years on various categories of products. Amazon Retail is owned by Amazon Corporate Holdings Pvt. Ltd., a Singapore based entity, whereas Cloudtail is owned by Prione Business Ventures, in which Amazon has a 23 % stake, AIOVA submitted.

- Amazon creates a lock-in effect: AIOVA stated that Amazon is one of the largest marketplaces in the world, and most sellers have no option but to sell on this platform or run the risk of losing out on a significant market presence. Because of this most brands invest capital and time to appear at the top of search results under the “Best Seller” or “Sponsored” category, which creates a lock-in effect as sellers, if intending to shift to other platforms, cannot transfer their “Reviews/Ratings” or “Best Seller” status to the other marketplace.

- Exploiting the COVID-19 pandemic by benefitting its own sellers: AIOVA alleged that Amazon, instead of accommodating more sales to independent sellers, exploited the pandemic by facilitating the sales of essential commodities sold by its own sellers, Amazon Retail and Cloudtail, by offering massive discounts such as 20% on groceries, 15% on snacks, 15% on beverages, 25% on household supplies, 25% on personal care, 30% on beauty products, and 35% on baby products.

These above practices rendered independent sellers unable to compete on the platform and resulted in the foreclosure of competition in the marketplace, AIOVA submitted.

Aggravating factors vs Ameliorating factors

Section 19 (3) of the Competition Act states:

The Commission shall, while determining whether an agreement has an appreciable adverse effect on competition under section 3, have due regard to all or any of the following factors, namely:—

a. creation of barriers to new entrants in the market;

b. driving existing competitors out of the market;

c. foreclosure of competition by hindering entry into the market;

d. accrual of benefits to consumers;

e. improvements in production or distribution of goods or provision of services;

f. promotion of technical, scientific and economic development by means of production or distribution of goods or provision of services.

AIOVA submitted that the anti-competitive agreements between Amazon and its partners resulted in aggravating factors under Section 19(3) (a), (b) and (c) of the Act, without the benefit of ameliorating factors under Section 19(3)(d), (e) and (f) of the Act, thereby leading to an appreciable adverse effect on competition in India.

- Aggravating factors: Amazon’s deep discounting is creating distortionary effects on the market that is creating barriers for new entrants and driving existing competitors out of the marketplace, resulting in the foreclosure of competition, AIOVA submitted.

- Ameliorating factors: Amazon’s failed to make significant improvements in building a distribution network, which was exposed during the pandemic, and Amazon’s conduct has resulted in the closure of a decentralised network of kirana shops, AIOVA submitted. The large platform fees have left sellers less revenue to invest in research and development, which impairs innovation and economy, AIOVA added. Overall, there has been a deterioration of supply chains and closure of smaller independent businesses, AIOVA said.

What did AIOVA seek?

- Imposition of penalty: AIOVA sought for the imposition of penalty on Amazon Seller Services, Amazon Wholesale, Amazon Retail, Cloudtail, Prione Business Services, and all other colluding entities.

- Interim relief: AIOVA also sought for interim relief that Amazon Wholesale, Amazon Retail, Cloudtail, Prione, and all other entities indulging in similar conduct be restrained from operating on Amazon’s marketplace platform until final orders.

- CCI declines interim relief: CCI, however, declined interim relief stating that Amazon “has a significant market share in India. Thus, the balance of convenience lies in its favour, and granting interim relief would prevent further irreparable harm to the market.”

Why did CCI dismiss the complaint?

- AIOVA failed to obtain a certificate under the Indian Evidence Act: In October 2020, CCI had directed AIOVA to file a certificate under Section 65B of the Indian Evidence Act, 1872, in support of the electronic evidence that AIOVA relied upon in filing the complaint. AIOVA, however, did not do the same despite several notifications sent to it, CCI noted.

- AIOVA failed to provide certain additional information sought by CCI: In orders sent in October 2020 and November 2020, CCI directed AIOVA to file certain additional information in the matter. Although AIOVA filed the information in December 2020, CCI observed certain discrepancies in the information filed and directed AIOVA to remove the discrepancies within a time stipulated therein. AIOVA refiled the information in January 2021, but CCI noted that this information was also not found to be in order. In February 2021, CCI once again asked AIOVA to file its submission after addressing the discrepancies, but AIOVA did not resubmit despite being sent reminders in June and July 2021, CCI noted. In September 2021, CCI decided to pass an order based on the information at hand.

AIOVA calls for ED to look into the matter for FDI violations

In response to the dismissal, AIOVA tweeted:

“We understand CCI has passed an order as we “failed” to provide information which could be admissible as evidence, the commission in para 26 has admitted “lack of platform neutrality” on Amazon India marketplace. An admission by CCI with material information on record proves that Amazon India is violating the FDI policy which requires it to remain a neutral marketplace. We hope the Enforcement Directorate (ED) takes this up.”

AIOVA’s comment is, however, misleading because para 26 of CCI’s order merely states that the complainant has alleged “lack of platform neutrality,” not that CCI has determined that to be the case.

This post is released under a CC-BY-SA 4.0 license. Please feel free to republish on your site, with attribution and a link. Adaptation and rewriting, though allowed, should be true to the original.

What will be the future of Antitrust and Competition in India?

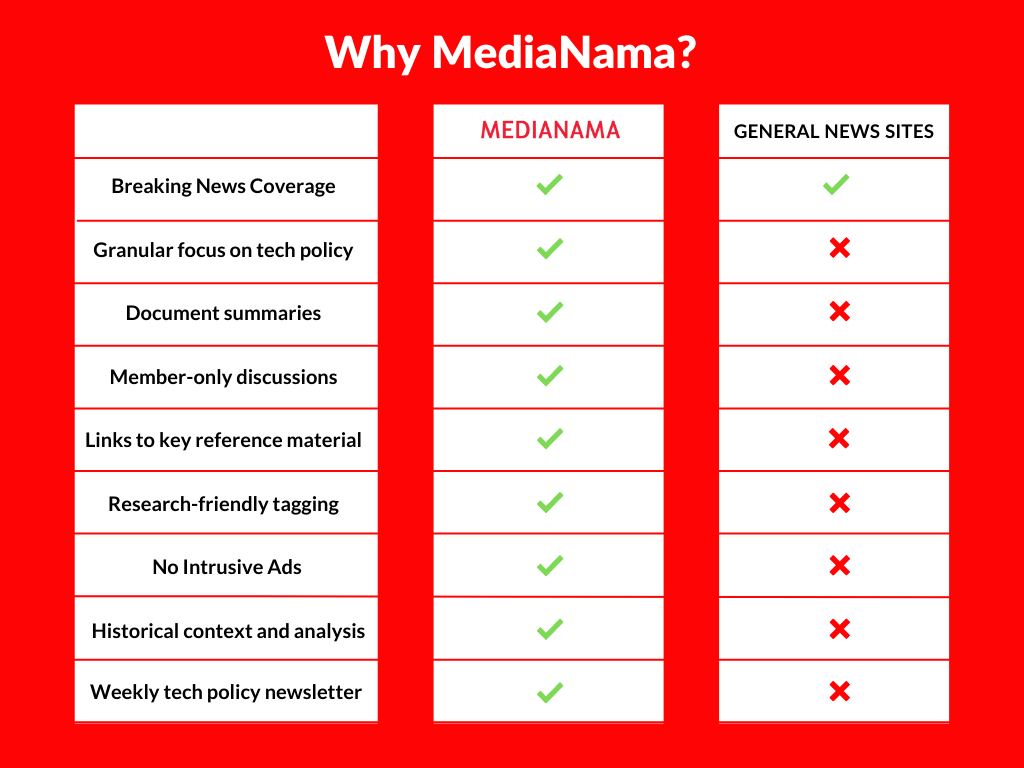

Do you want to keep track of antitrust developments in India but don’t have the time? Relying on scattered content from across the web makes it feel harder than it needs to be.

Subscribe to MediaNama and get crisp, timely updates on tech policy developments in India and across the world.

Also Read:

- Amazon Challenges CCI’s Suspension Of Future Coupons Deal At NCLAT, Moves Supreme Court Against Delhi High Court Order

- CCI Launches Another Investigation Into Google, This Time Over Abuse Of Dominance In News Aggregation

- Amazon Has Found Cloudtail’s Replacement For Electronics In Dawntech: Report

- Summary: CCI Orders Detailed Antitrust Investigation Into Apple Over App Store Practices

Have something to add? Subscribe to MediaNama here and post your comment.