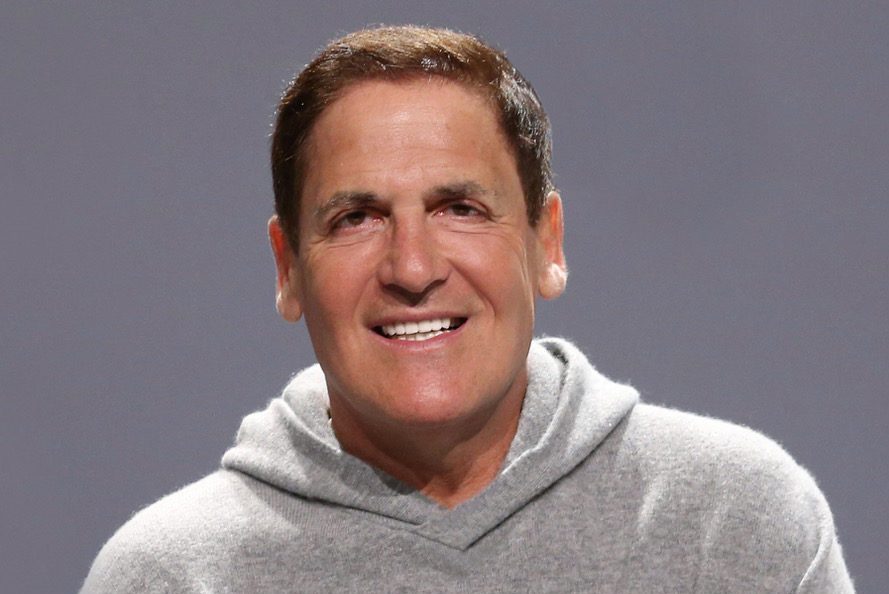

Veteran investor and serial entrepreneur Mark Cuban expanded his blockchain portfolio, purchasing a "sizeable" stake in Polygon, the Bengaluru-based blockchain firm."I was a Polygon user and find myself using it more and more," Cuban told CoinDesk in an email. Polygon, which was earlier called Matic Network, is one of the fastest growing blockchain companies in the world. The company built a secondary blockchain, on the same design contours of the Ethereum blockhain. But unlike Ethereum which suffers from high transaction costs and slow processing speeds, Polygon’s network is much cheaper and faster since it sheds some of the burden and traffic on the Ethereum network. At the same time, Polygon ensures that all transactions are eventually reported on the Ethereum blockchain. https://twitter.com/0xPolygon/status/1397236024498180107 Cuban, who pioneered online streaming back in the '90s and owns the Dallas Mavericks basketball team, has a net-worth of around $4.4 billion and has invested in over 100 companies. The Shark Tank judge is a major backer of crypto-currencies and has investments in several blockchain firms like Mintable.app, Zapper, Injective Protocol and CryptoSlam. He told CoinDesk that he would integrate Polygon's blockchain tech-stake into one his portfolio companies called Lazy.com. Lazy essentially allows artists and others to promote their non-fungible tokens (NFTs). "Polygon is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development...Polygon’s scaling solutions have seen widespread adoption with 250+ Dapps, ~76M txns and ~790K unique users," the website of Cuban's portfolio companies said. The investment from Cuban comes at a significant time and…