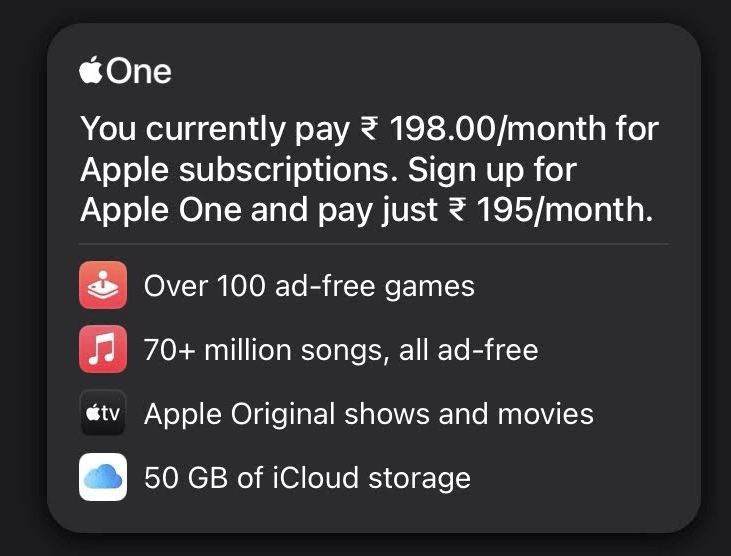

Apple's bundled subscription service Apple One has gone live in India, at a much lower price than the service's US pricing. Apple Music, Apple TV+, Apple Arcade (the on-demand game app service), and iCloud storage are being bundled for individual subscribers at ₹195 per month, and ₹365 per month in India, as the company had announced earlier. In the US, Apple One costs US$15–20 per month, which is over five times the rate in India. Apple One does not include Apple Fitness+ and Apple News+ in India, as neither service is available in the country. The launch is significant for two reasons: one is, of course, the price, which is so low it almost seems to be subsidised by Apple One sales in other territories (much like YouTube Premium), and the second is the way it leverages Apple's marketplace dynamics towards itself. Apple can afford two things its competitors cannot: pricing efficiencies in bundling, and an (obvious) exemption from having to pay a 30% fee on the App Store. Estimating Apple One revenue for India With these dynamics, how much can Apple One earn in India? Let's go with the best case scenario: Apple convinces every single iPhone user in India — which techARC chief analyst Faisal Kawoosa estimates to stand somewhere around 12 million — to subscribe to Apple One. Even if they pull that off, Apple will have two headwinds: one is the 18% Goods and Services Tax and the 2% equalisation levy that it charges on digital…