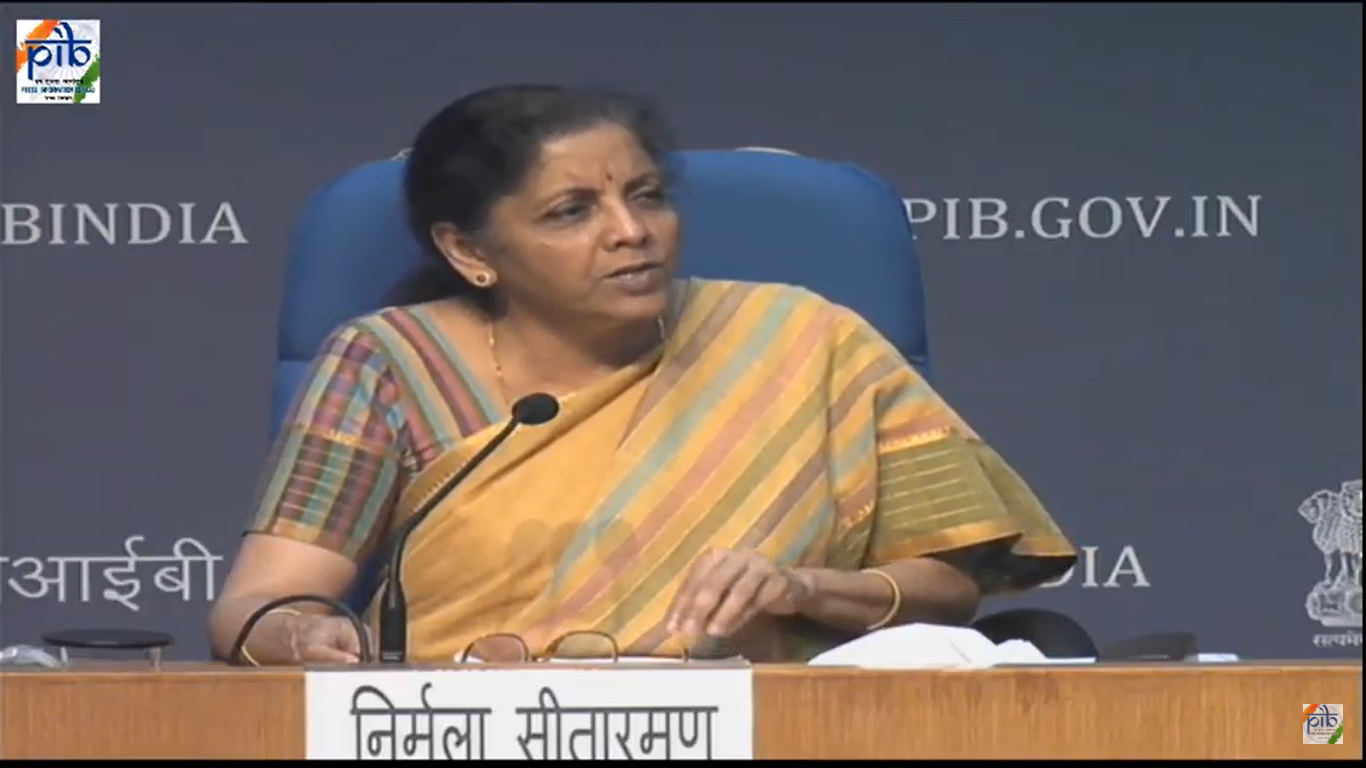

The central government will propose extension of social security to gig and platform workers in the Parliament, as part of labour reforms and benefits, Finance Minister Nirmala Sitharaman announced today as part of the second tranche of economic measures for relief from the COVID-19 crisis. "They [gig and platform workers] are an urban phenomena and they should get protection," The proposal is part of labour codes to be introduced in the Parliament, 44 labour codes have been compressed into four labour codes. Sitharaman did not clarify when and how how the codes will be introduced in Parliament. The government will introduce national portability for ration cards, where any ration card can be used at any Fair Price Shop in the country. Sitharaman claimed this will benefit 67 crore people in 23 states, or 83% of the PDS population, by August 2020. States and union territories will have to complete 100% national portability by March 2021, Sitharaman said. A family member living in another city can withdraw the leftover ration quota using his Aadhaar number, and that is the point of portability, finance secretary Ajay Bhushan Pandey — also former UIDAI CEO — said. He was responding to a query about how the family of a ration card holder will make use of this step. Other labour reforms to be proposed (in Parliament): Regional disparity in minimum wage will be resolved by a proposed National Floor Wage Annual health check-up to be mandatory proposed All occupations should be open for women with night working…