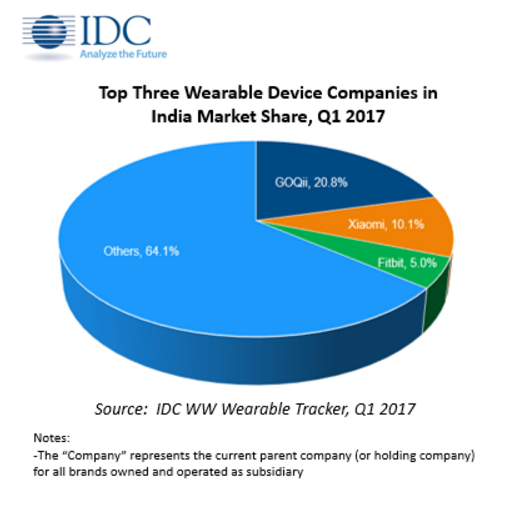

The competition between Chinese and domestic brands is not limited to smartphones. India’s GOQii continues to hold the first position in terms of wearable shipments in the country holding a 20.8% market share in Q1 2017, according to research firm IDC’s Quarterly Wearable Tracker report. This is up from a 15.5% share that GOQii held in the previous quarter. During the quarter, GOQii shipments increased by 21% quarter-on-quarter (QoQ). The GOQii Heart Care tracker program and promotional upgrade offer helped it maintain the first spot. Xiaomi had taken to the first spot in Q1 2016 when it had a 27% market share in terms of shipments, sustained by its Mi Band (1st Gen) shipments. In the next quarter (Q2 2016), GOQii surpassed Xiaomi to secure the first position (with 16% market share) after it made an aggressive entry into the fitness band category by launching GOQii band 2.0. Note that Xiaomi also launched an upgraded version of its Mi Band at around the same time that GOQii entered the market with its new product line. Overall, the Indian wearable market shipped 612,000 devices during Q4 2016, down 9.3% QoQ from the previous quarter. These units include “smart wearables” that can run third-party apps (Apple Watch, Samsung Gear) and basic wearables which cannot run third-party apps (Mi Band). Shipments by Category The cheaper basic wearable segment accounted for almost 90% of the overall shipments in India during Q1 2017. The reason behind the segments dominance include low (entry) prices, and better value for the…