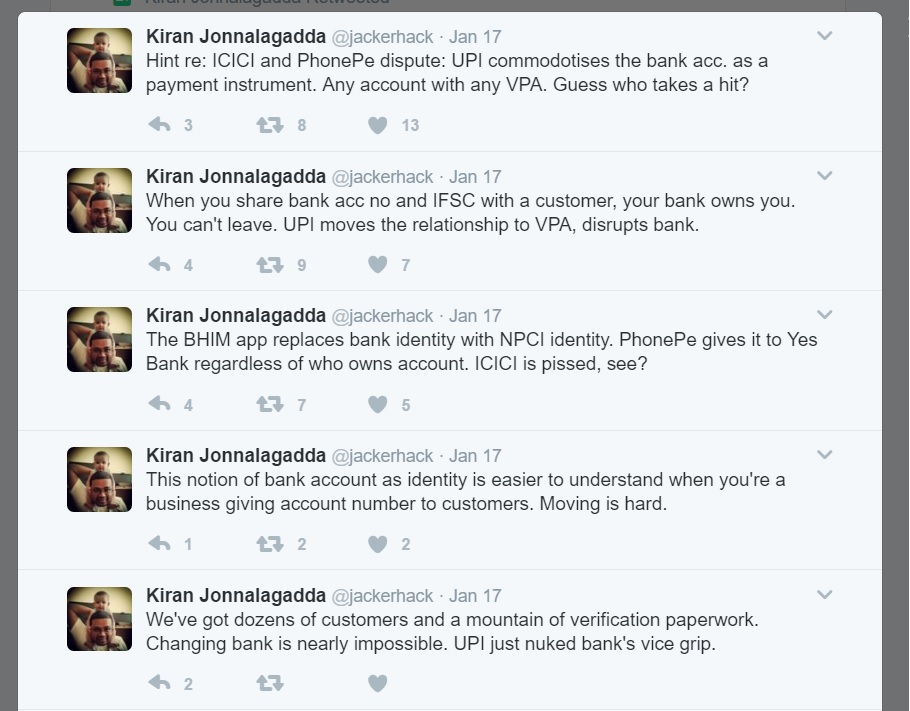

So, let's play a game. It's called read between the lines. Earlier this week, ICICI Bank blocked UPI payments from PhonePe, a Flipkart-owned YES Bank application; PhonePe said that more than 20,000 transactions with total value of over Rs 5 crore failed because of ICICI Bank's move. In continuation of the interconnection drama, yesterday, MediaNama received statements from YES Bank, PhonePe/Flipkart, ICICI Bank and the National Payments Corporation of India, the private, bank-owned body which runs UPI. So the object of the game is to figure out what exactly has been happening behind the scenes here, between these four, because we really cant figure what is going. Leave a comment. Tell us what you think. Let's start with YES Bank then which sent in a statement at 11:20 am. Mumbai, January 19, 2017 : There were concerns raised by a UPI member bank in the media recently over the security of the application and customer data confidentiality with regards to our partner Phonepe, offering UPI services. YES BANK has not received any such query or information from NPCI. YES BANK would like to confirm that: 1. The PhonePe application has complied with all the prerequisites as mandated by the network association. 2. The process laid out by NPCI involves detailed certification, vulnerability assessment, penetration testing, application security, 3rd partly security audits and a host of other procedural guidelines, all of which have been complied with. 3. In fact, all member banks who are offering the UPI services have undergone exactly the…