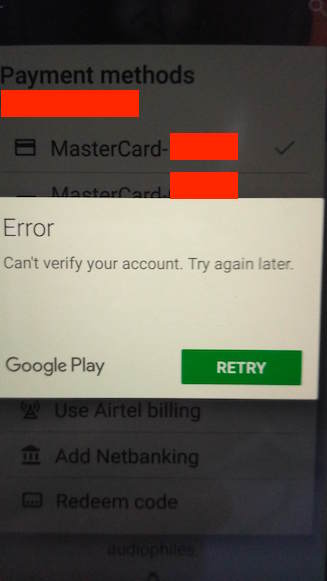

Update: Google has confirmed to MediaNama that this carrier billing integration is only for postpaid services, and not for prepaid. Thanks for flagging this Prasanto. Yesterday: It has been a long time coming, but Google has finally launched carrier billing with Airtel and Vodafone, two of India's largest telecom operators. This is in additional to Idea Cellular, which means that Google Play carrier billing will be available to 186.26 million Internet connections among these three. Add Reliance Jio to this mix - it isn't there - and you have approximately 240 million connections that now have an option to pay for online content with their mobile balance or bill. The Airtel integration (we tried) is buggy: while the option of carrier billing is available to users, Google Play isn't able to verify user telecom operator accounts to initiate and authenticate the payment...the irony of a telecom operator not being able to initiate a confirmation SMS. It's not clear as to how the revenue share relationship between the two carriers and the Play Store works, but there is a detailed overview of the Idea Cellular - Google Play Store relationship here. MediaNama's take 1. Better late than never: It's shameful that it has taken the telecom industry this long to enable this: they have been, unfortunately, blind-sided by the ambition of being content providers, and competing with the open Internet, which we've seen in Jio's launch of apps and services, and Airtel's attempt at music and video services. The only competitive…