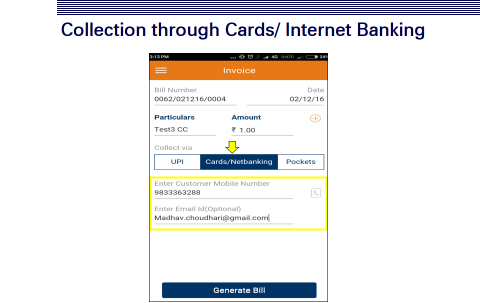

ICICI Bank has now launched a payments collection app for offline merchants and retailers called Eazypay which will allow customers to pay via UPI, cards, net banking and the bank's Pockets wallet app. Note that this is an app only for ICICI Bank customers who have a current account with the bank and will not allow other bank account holders to register on the app. Merchants have to create a virtual payment address (VPA) and set an m-PIN. Note that for the UPI, banks are allowed to charge a merchants a higher bank interchange fee than compared to P2P payments. We have asked for more details on how this works and will update as an when the bank gives more information. The app also allows merchants to collect payments over QR code. But interestingly, screenshots from ICICI Bank says that it will process the QR code payment over the UPI. QR code payments have been picking up steam in India following demonetization and card networks Visa and MasterCard have been pushing their products mVisa and Masterpass respectively for QR code payments. We have asked the bank for a demo on how these payments will occur over the UPI and will update when we hear from them. The UPI option on the payment app also allows merchants to collect immediately or at a later time. Card payments and net banking: For card and net banking payments, customers will need to enter their phone number and email which will generate a bill along…