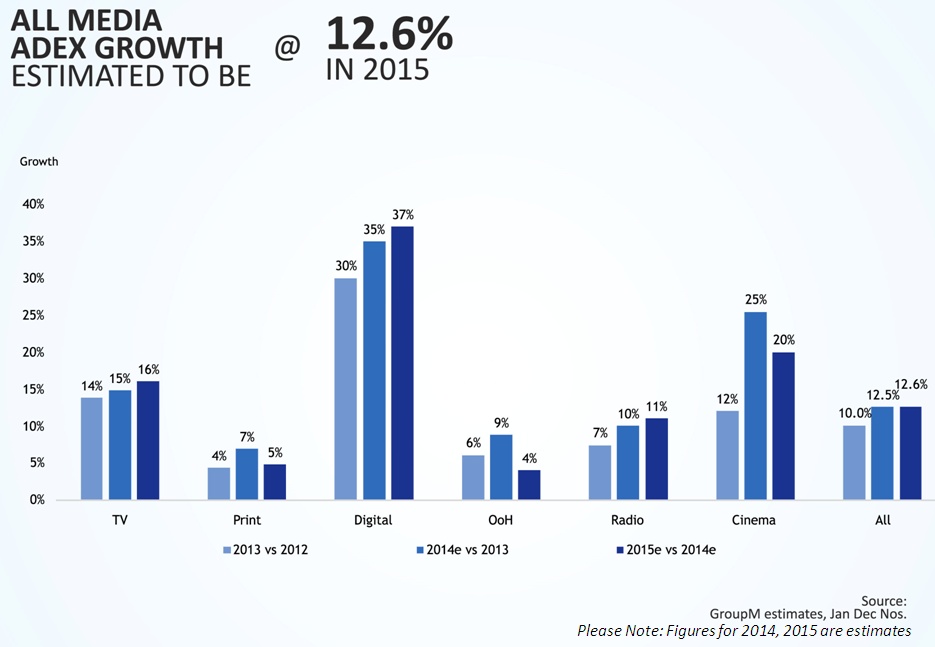

Advertising spends in India are expected to grow 12.6% year on year to Rs 48,977 crores, of which Digital Advertising spends will account for Rs 4,661 crore, according to estimates by GroupM. The growth in 2014, to Rs 13,490 crores, is being attributed to an increase in spending due to elections (both General and State elections), as well as advertising from categories like e-commerce and Telecom. "The FMCG sector, which contributes to nearly a third of the AdEx, had a steady year, growing broadly in line with the industry average," GroupM said in a statement. CVL Srinivas, CEO, GroupM South Asia said in a statement that advertisers are cautious but optimistic: "With a new Government coming to power the negative sentiment has lifted but there is still some bit of caution amongst advertisers.We continue to operate in the same zone as last year at an overall level." In addition, GroupM is "seeing a lot more confidence amongst local businesses to invest in brand building than before. This is a positive sign for the industry. Penetration of smartphones coupled with the popularity of online video is making FMCG spend more on digital. Another trend is the emergence of categories like e-Commerce and the increased competition in Telecom both of which are aiding the growth of traditional media channels including Print and TV apart from Digital." Expectations - e-Commerce is expected to lead the charge in 2015 in terms of ad spend growth although from a relatively smaller base than more established categories. There…