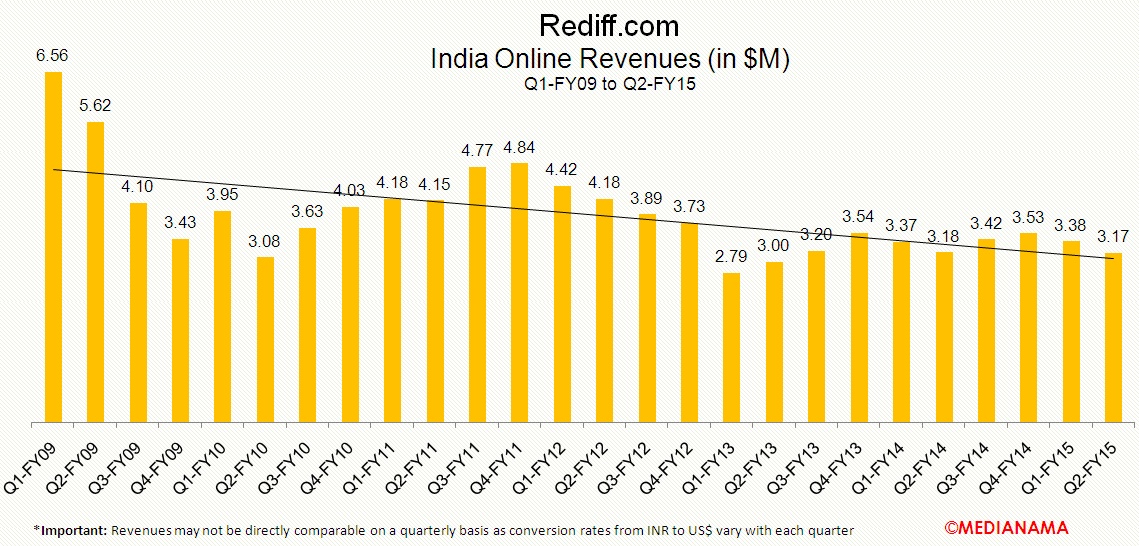

Not happy news for Rediff.com investors on the day before Diwali, as the company announced a $3 million loss and a 22% decline in advertising revenue. What's particularly worrying is that Rediff has only $12.5 million cash in bank, which means that the company will have to raise money, increase revenues and/or cut costs. While a quarterly results comparison isn't possible with Rediff, since it earns most of its money in Indian Rupees and reports results in US Dollars, and exchange rates vary each quarter, it's worth noting that the company reported a loss of $3.48 million in the last quarter, and $3.39 million in the quarter before that. Another four quarters of $3 million in losses and it will run out of cash. It has 16.5 million monthly unique users, up 17.5% year on year, but that clearly isn't contributing to revenues. Only once since the quarter ending June 30th 2009 has Rediff reported a profit, that too, on the sale of an investment which brought it $2.74 million; without that sale, it would have reported a net loss of $1.68 million in that quarter, and it would have been 26 consecutive quarters (six years and two quarters) of losses. At the time of filing this report, Rediff's share was worth $2.08, and its market cap is $57.39M. Online advertising revenues decline 22% In its earnings release, Rediff tries to position the 22% decline in its online advertising revenues, and the increasing dominance of its shopping business as "the emergence of an internet media…