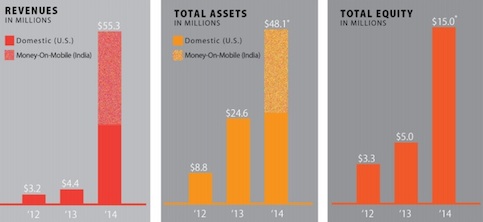

Calpian-backed mobile money service Money On Mobile has reported revenues of $29.4 million (around Rs 180 crore) for the quarter ended March 31, 2014. Note that this is the first quarter where Calpian has consolidated Money on Mobile's revenues within its financial results, which otherwise was earlier reported as an investment. What's really interesting here though is Money on Mobile has made more money for Calpian in a single quarter than what Calpian earned in its domestic US market for the whole year. Calpian reported domestic revenues of $25,5 million for the year ended March 31, 2014. The overall consolidated revenues of Calpian was at $55.3 million for the year. Calpian notes that it has included only the fourth quarter's revenues of Money On Mobile in its financial results, since the company achieved majority ownership only in Q4-FY14. It had increased its stake in Digital Payments Processing Limited (Money On Mobile) to a majority 69%, up from 49.9% stake as of December 2013. Money On Mobile Annual revenues: For the full year ended March 31, 2014, Money On Mobile reported revenues of Rs 897.3 crore, registering a 37.3% growth from Rs 653.7 crore revenues in the previous year and up from Rs 447 crore revenues in the year before (FY12). User base: Calpian claims that Money On Mobile was accessed by 5.8 million unique users in June, of which 3.6 million users were unique users. The service has apparently been accessed by 95 million unique users since its inception. It is now offered through 1.99 lakh retail locations (198,827 retail locations), up from 1.93 lakh retail…