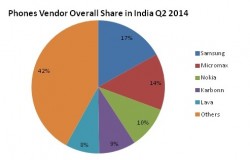

Around 81% of 18.42 million smartphones shipments in India in Q2 2014 were sub-$200 smartphones, according to a report from IDC. It says the total smartphone shipments grew in India by 84% year-on-year from 10.02 million smartphones in Q2 2013. On the sequential basis, it grew by 11% quarter-on-quarter. The company attributes the growth to the reduced prices of smartphones and continuous migration of users from feature phones to smartphones. The feature phone market is declining but it still accounts for 71% of the total mobile phone shipments for the quarter. In comparison, it had contributed for 84% of shipments in Q2 2013. Note that IDC calculates sales of mobile handsets by tracking the number of handsets that leave the factory premises for OEM sales or stocking by distributors and retailers. For imported handsets it’s the number of handsets that leaves the first warehouse to OEMs, distributors and retailers. It does not account for handsets brought in by individuals into the country or the grey market and MediaNama is not in a position to verify the accuracy of the findings. Samsung and Micromax dominating the market Samsung has continued its dominance, holding 29% of smartphone market share last quarter while the Indian handset maker Micromax stands next to Samsung with 18% market share. However, what’s interesting is that when you add feature phones into the mix, the line between the top two contender blurs more than ever. Samsung is leading the chart with 17% of overall mobile handsets, while Micromax has 14% share, surpassing Nokia. Among other vendors,…