The Reserve Bank of India (RBI) recently released the draft guidelines for licensing of Payment Banks and Small Banks. The guidelines borrow heavily from the Nachiket Mor Committee report released earlier this year. Regrettably, the guidelines have not borrowed as much from the report of the Working Group on Payments, of the Financial Services Legislative Reforms Commission. The recommendations in that report attempt to address deeper, more fundamental ailments of the Indian payments ecosystem that stymie innovation and put us, on this count, behind even our neighbours Pakistan & Bangladesh.

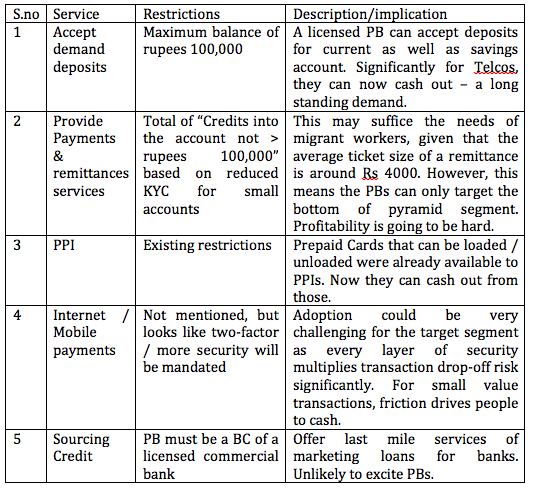

First a brief summary of the scope of what a Payments Bank (PB) will offer to be “differentiated” is in order.

Now on to outline areas where the guidelines are wanting, with the hope that some of them will be rectified when the draft guidelines are finalized.

– Possible business models: The guidelines state that the PB will not be allowed to issue asset/credit products (loans); will need to maintain CRR & SLR and invest all deposits collected in government securities or treasury bills. This implies that the business model must primarily be based on transaction fee, as the Net Interest Margin (NIM) Income available for PBs will range from slim to none. Given the general reluctance (5% electronic) to adopt electronic payments (plastic money / online payments) it remains to be seen as to how PBs build a pure transaction fee income based business.

– No comments on interest on deposits: There does not appear to be specific mention of whether or not PBs will be required to pay interest on the deposits and if so, whether these will be in line with those for existing licensed commercial banks. Paying interests on deposits will bring in significant added costs to PBs possibly making the whole project unviable.

– Charges for services offered: It is also not clear if the RBI will adopt a “tariff forbearance” view allowing PBs to discover market pricing for services offered – including for cash deposits, withdrawals, payments and remittances as is the case currently for PPIs and in the remittance business – or will step in and specify. PBs likely will want the former.

– High capital requirement will keep disruptive innovaters out: Which brings us to the paid up capital requirement for 100 crore. The demand deposits PBs need to cash-out in the event of a ”run on the Bank” by its depositors are presumably already secured through the measures mentioned earlier. It seems unclear how this capital requirement condition helps; it will keep small, potentially disruptive innovators out.

– Interoperability with existing banks and conflict of interest: One would argue that mandating interoperability with existing commercial banks (through open access to existing national switching infrastructure) as well as across PBs should automatically address the deposit risk from a consumer protection standpoint [cash out from any Bank]. Particularly, since the maximum account balance allowed is a just one lakh rupees per account.

The cost of carrying cash to the last mile, managing fake currency, controlling denial of service and agent overcharging, as well as tying up with banks or white-label ATM (WLA) providers to handle cash-out will all load the cost side of the PBs balance sheet significantly. Meanwhile, banks do all of this anyway, so they have little incentive to help PBs, other than their subsidiaries succeed. That causes a major conflict of interest. Even if one of the WLA players (e.g. Tata) decides to swing a sweet deal with its PB, the commercial bank sponsor is still in the equation through the WLA norms. The guidelines are silent on this.

– Monitoring expansion when Internet only: The Business Plan section of the guidelines talk about preference to PBs providing access points in unbanked districts & remote areas. RBI also plans to “restrict” expansion plans if there is deviation from the stated business plan. It is not clear as to why the objective of financial inclusion – which makes no sense without credit – is being pushed to the PBs. Given that under Scope, the PB is allowed to be “internet only” it is puzzling how the RBI will monitor service outlets / expansion as it is simply not practically feasible for the RBI to do so. This is where the first recommendation of the WG-FSLRC should find use. Allowing self-registration would have perhaps been a much better way to go.

– Shareholding restrictions: The shareholding restrictions also seem to be vestigial clauses from full commercial licensing. It is not clear why these restrictions need apply to a purely payments bank, given that there is no credit risk at all. One certainly hopes that the RBI will re-examine & adopt a few more of the WG-FSLRC recommendations.

– Need paper-free KYC: That the guidelines should have to recommend technology use by PBs to lower cost is startling. It is hard to see any business today eschewing technology to reduce costs & achieve scale. Even the Department of Post is upgrading with some serious capital expenditure investments in tech. The bigger question is whether the RBI is willing to make KYC entirely electronic & paper free. No forms, no wet signature, even where there is no Aadhaar based eKYC. That would seriously push the envelope as well as make customer onboarding less expensive and less painful for PBs.

– Why is licensing so selective? Since the guidelines already acknowledge that “the Payments Bank will have almost zero or negligible risk weighted assets” it is not clear why the licensing needs to be so selective. A more free-market approach will allow innovators to win. The RBI is empowered to apply additional restrictions to such winners in the consumer interest at a later time & concomitantly frame regulations on how failed entities can be wrapped up through proper bankruptcy procedures or similar guidelines.

While the initiative to allow Payments Banks is a welcome move, the actual guidelines fall short of the expectation of appropriate risk based regulation to foster a playing field that encourages innovative payment systems / providers in India to meet the surging demands of the e-commerce, mobile payments as well as financial inclusion needs of India. The need to tightly control this defanged entity through a stringent licensing regime is somewhat mystifying.

A suggestion: how about a digital currency for Payment Banks?

On a final note, here is something completely out of the box to think about. The RBI exercises full control over monetary policy, printing currency, declassifying notes and managing the level of cash/liquidity in the economy. In the opinion of this writer, it would be revolutionary if the RBI simply decided to take on the job of issuing “digital currency” to the PBs against cash deposits they maintain in a pooled account with the central bank – very similar to what every BC in this country already does for its distribution / channel partners today for remittances and every Telco with prepaid talk time.

Technologically it is fairly straightforward to implement. It provides 100% CRR, ensures Zero Risk. As the central bank also settles funds across the financial network, interchange and cash management fees can be reduced drastically promoting a less-cash revolution – something that the RBI has passionately argued for. Similar to demands for demonetizing Rs 500 / Rs 1000 denominations for completely different reasons, this could be a route to demonetizing lower denominations. Imagine RBI not printing/minting any currency less than Rs 50. In doing so, the RBI will completely level the playing field with the existing licensed commercial banks. Never say never?

*

Anand Raman has over two decades of professional experience across Financial Services, Telecommunications, IT and Media. In the last five years he has been deeply interested and involved in the Financial Inclusion movement in India as part of the early team of a national Business Correspondent. Prior to that he was part of leading media and telecommunications businesses focused on Mobile enablement of content services.