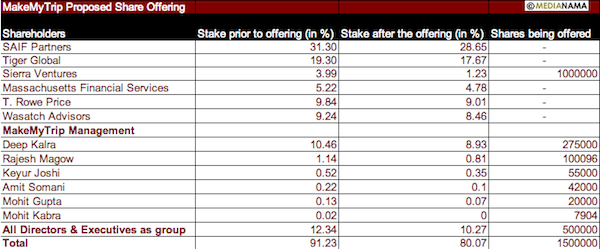

Online travel agent MakeMyTrip has proposed a fresh sale of 4.5 million ordinary shares on NASDAQ - 3 million of its own and 1.5 million of certain selling shareholders - in a public offering. Its shares closed yesterday at a price of $24.87 (down 3.42% yesterday) and at that price, the offering will be a total $111.9 million. MakeMyTrip will be offering 3 million ordinary shares (worth $74.6 million at current rates) while certain shareholders will be offering to sell 1.5 million ordinary shares (worth $37.3 million at current rates). It will not receive any proceeds from the sale of shares to be offered by the selling shareholders, so, in effect, is raising $74.6 million for its own use. The company, at present, has $32.2 million of cash and cash equivalents and $35.2 million in term deposits with various banks, so the need to raise additional funds is unexpected. It says it plans to use the net proceeds received to expand its operations by acquiring or investing in strategic businesses or assets which complements its service, invest in improving its technology as well as for working capital and other general corporate purposes. The company however notes that it has not entered into any agreement or commitment with regards to any acquisitions or investments. It has appointed Citigroup, J.P.Morgan and Deutsche Bank Securities as joint book running managers of the offering. Who Is Selling, And How Much MakeMyTrip mentions that the selling shareholders and another shareholder (SAIF Partners) have granted the underwriters a 30-day option to purchase an additional…