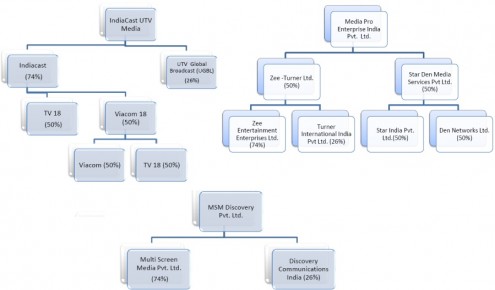

In a regulation released yesterday, the Telecom Regulatory Authority of India has attempted to put an end to what may be deemed as cartelization from major Indian broadcasters, via distribution firms in which the broadcasters themselves own stakes. Note that these distribution firms - like Indiacast, Media Pro and MSM Discovery - also distribute content to IPTV providers, and some, like Indiacast, also distribute content on YouTube in India. The TRAI has announced the following key changes to regulation, which might end up being contested in court, since it threatens the existence of these businesses: - Only a broadcaster shall publish Reference Interconnect Offers (RIO's) and enter into interconnection agreements with Distribution Platform Operators such as cable operators, MSO's and DTH companies. - The broadcaster can use an authorized agent, which acts on behalf of the broadcaster, but will have to ensure that the agent does not alter the bouquets offered in the RIO of the broadcaster. - In case an agent acts as an authorized agent of multiple broadcasters, the individual broadcasters shall ensure that the agent doesn't bundle its channels with other broadcasters. Only broadcast companies belonging to the same group can bundle their channels. The TRAI has given broadcasters 6 months to amend their interconnection agreements, and file them with the TRAI. Broadcasters have opposed these, on the grounds that they are in violation of Article 19(1)(g) of the Constitution and on the ground of jurisdiction of TRAI in the said matter. They have also argued that the Competition Commission of…