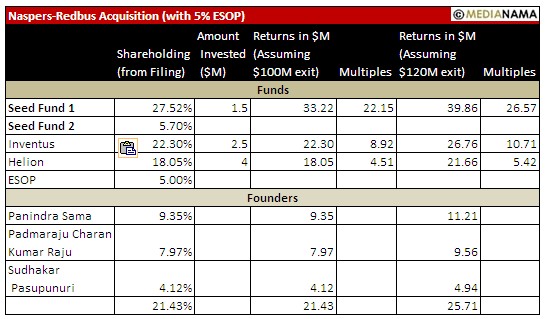

Pilani Soft Labs, the company which owns Redbus.in, the bus ticketing venture which has been sold to South African media conglomerate Naspers for a reported figure of between $100-120 million (Rs 598-712 crore at current rates), reported net revenues of Rs 32,87,00,903 (around $5.55 million) for the year ended 31st March 2012, up 170.72% from Rs 12,14,18,304 (around $2.05 million), according to the companys filings with the registrar of companies. For the year, it reported a profit of Rs 58,11,982 ( around $98,146), as opposed to a loss of Rs -3,15,97,386 (around $533,585). Note that this is net revenue for the company, which was reported to have clocked net revenues of Rs 55 crore and a gross merchandise value of Rs 600 crore (around $100 million) for FY13, and a net profit of around Rs 2 crore. The company was clearly on the growth path, and for the market leader in the bus ticketing space in India, it was an attractive proposition for Naspers to add to their travel portfolio with GoIbibo. Earlier this week, Anand Lunia of IndiaQuotient had questioned whether the returns made from even this large an investment would enable venture capitalists to return money to their investors. The post was then taken down, but he did subsequently write again about the issue, without the numbers. We crunched some numbers based on shareholding given in the RoC filings, to check what kind of returns the investors would have made, and how much the founders would have earned.…