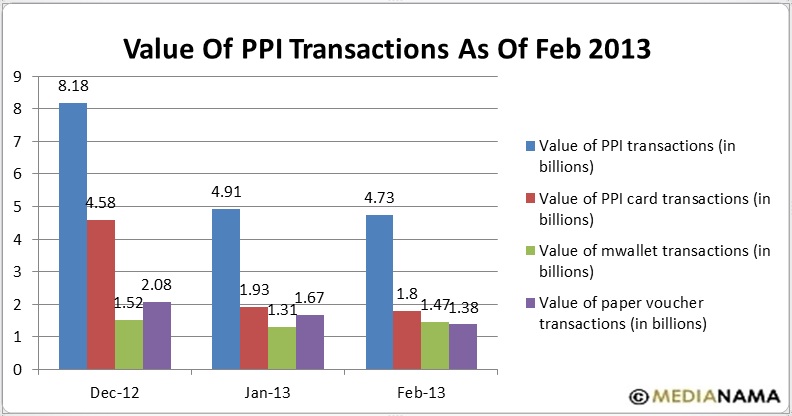

A total of 7.33 million Prepaid Payment Instrument (PPI) transactions worth Rs 4.73 billion were generated, as of February 2013, according to the latest numbers from the Reserve Bank of India. This includes 5.41 million m-wallet transactions worth Rs 1.47 billion, 1.89 million PPI card transactions worth Rs 1.88 billion and 0.03 million paper voucher transactions worth Rs 1.38 billion. RBI however has not provided any break down across different types of wallet - closed wallet, open wallet, semi-closed and semi-open wallets. Volume of Transactions - The total number of PPI transactions stood at 7.33 million transactions for February 2013, a significant increase from 6.68 million transactions in January 2013 and 7.18 million transactions in December 2012. - Among the different instruments, only m-Wallet transactions have shown growth in the number of transactions for the period Dec 2012 - Feb 2013. The number of transactions increased to 5.41 million transactions in February 2013 from 4.66 million transactions in January 2013 and 4.17 million transactions in December 2012. - PPI card transactions however decreased to 1.89 million transactions in February 2013 from 1.98 million transactions in January 2013 and 2.96 million transactions in December 2012. - Paper voucher transactions also decreased to 0.03 million transactions in February 2013, from 0.04 million transactions in January 2013 and 0.05 million transaction in December 2012. Value of Transactions - The total value of transactions has decreased to Rs 4.73 billion in February 2013 from Rs 4.91 billion in January 2013 and Rs 8.18 billion in December 2012.…