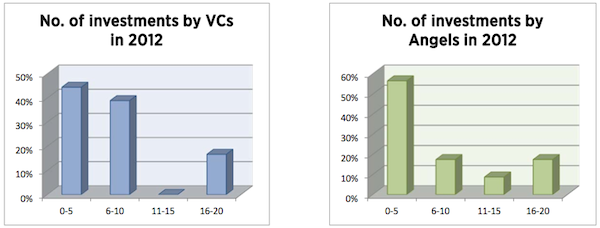

Around 40% of the venture capitalists (VCs) and around 50% the angel investors in India made less than five investments in Indian startups during the year 2012, according to a survey compiled by Global SuperAngels Forum (GSF). Methodology: The company says it had surveyed 40 venture capitalists and angel investors through an online questionnaire for this initiative and the report was compiled based the responses received and GSF's inputs based on its work with startups and its network of advisors and partners. Here are some highlights from the survey: - Most venture capitalists closed less than 10 investments while most angels closed less than five investments. Several formerly active angel investors didn't invest at all in 2012. - In the deals that were closed, the participation of venture capitalists in seed rounds has significantly increased as compared to venture round investments. The report states that VCs participated more in seed level investments rather than Series A investments, indicating that VCs are taking lesser risks and picking their bets. Citing several unnamed VCs and angel investors, the report stated that there will be a slowdown in Series A investments in 2013 and exits will be even harder to come by during this period. - VC Investments & Angel Investments Breakup: Seed round investments accounted for 42% of the venture capital investments in 2012, followed by Series A investments which accounted for 36% of the investments in 2012. Series B accounted for 12% of the investments while higher investment rounds accounted for 11% of…