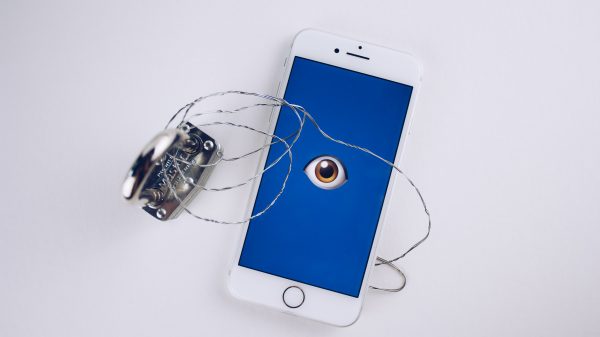

PayMate, the mobile payment company, has launched a PayPOS mobile application, which allows small businesses to accept credit and debit cards and process electronic transactions directly on their mobile phones at the point of sale (POS). The application has no setup fee, rentals, variable fees or minimum transaction threshold. How this works? Merchants with a Smartphone or tablet (Android, iPhone, and iPad) can download the PayOS app on their phone. The merchant, after registering with the service, will be provided a Merchant ID (MID) and a Device ID (DID) that will enable him to use his mobile phone as a POS device and have the Merchant name show in the customer’s card statement. Following that, he just needs to enter his mobile number and the amount on his smartphone. The customer enters the card details and the secure password or OTP. The transaction is then processed in real time. The credit card payment gateway fee of 2.95% + taxes will be charged over and above transaction amount during settlement. However, merchants can also pass on the fee to the customers by including it in the total amount they charge their customer on the app while initiating the payment. In the international markets, payments company PayPal charges 2.7% for payments through its 'PayPal Here' mobile payments solution, while Square charges 2.75%. PayPOS currently supports Visa and Master Card credit cards and debit cards. Apart from charging the customers, the PayPOS app also allows them to track sales, manage reports, create promotions that…