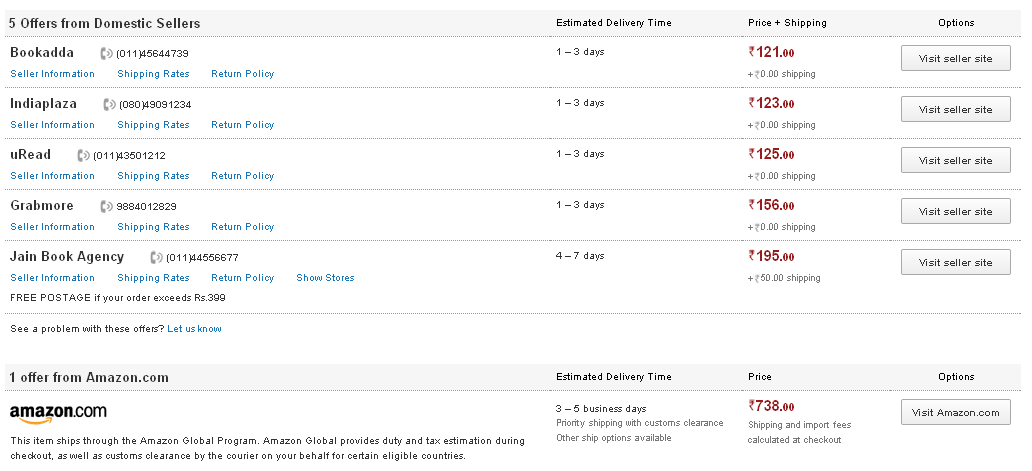

Well, looks like we were right about Amazon launching in India as Junglee.com: the site has gone live and features 120 million products from 14,000 brands, reports BGR India. What's particularly interesting is the way Amazon has positioned it - as an advertising service for product ads, thereby acting as an aggregator for Indian online retailers, pitting retailer against retailer for similar products. The site clearly states: "You cannot buy directly from Junglee. Junglee puts you in touch with sellers by directing you to their websites, displaying their customer service phone numbers and providing their physical store locations to help you buy the products directly from sellers." Competing With Partners - Homeshop18 - UniverCell - Hidesign - Gitanjali - The Bombay Store - Fabindia - Bata India Limited - Dabur Uveda - Microsoft India Store - Reebok - uread - Jain Book Agency - Amazon.com - Illrdi Digital - Techshop India - The Electro - Snapdeal - Saholic - Timtara - UniverCell - IndiaPlaza - Crossword.in and several others. Notes - Product Centric, Not Retailer Centric: if you see in the screenshot above, for a book, competing retailers are listed, and the consumer can choose among them. What you have to keep in mind is that over a period of time, the price won't be as much of a consideration when it is a difference of a couple of rupees; in that context, the ratings for retailers and the delivery time will matter more. - Amazon.com Is Listed Too: Among the retailers listed, we…