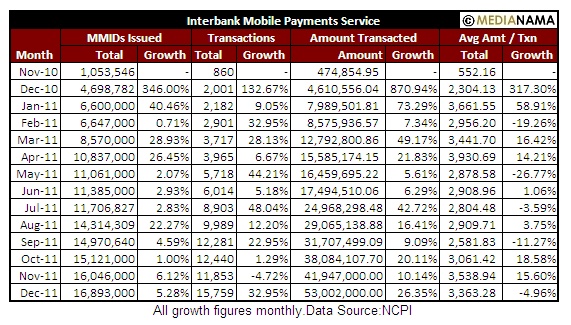

The Interbank Mobile Payment Service saw a growth of 32.95% in the total transactions taking place, with a 5.28% increase in total number of Mobile Money IDs (MMID) being issued, according to data published by the National Payments Council of India. The growth in transaction volumes, from 11,853 to 15,759 marks an increase in the growth of transactions month on month. The growth in the average transaction amount was negative at -4.96%. Also, it looks like the NPCI conducted an audit, since the recent volume analytics page has new numbers even for the previous months. However, we have decided to continue with the earlier figures. Details: Things might change once merchant transactions are enabled (at present only P2P payments are allowed), but there is no guarantee of that; the pilot for merchant transactions began in June. 33 banks have so far signed up for IMPS with 7 banks including Catholic Syrian Bank , IDBI Bank, Indian Overseas Bank, Andhra Bank, State Bank of Bikaner and Jaipur, Bank of Baroda and Dhanlaxmi Bank in Soft Launch. The IMPS page now has customer care numbers, to enable people to get MMIDs. Amongst banks, AxisBank has issued the maximum number of MMIDs a 49.44 lakh, followed by ICICI Bank with 30.65 lakh MMIDs and SBI with 25.42 lakh MMIDs.The more the MMIDs, the more the likelihood that P2P transactions will take place, and maybe, there will be more transactions than there are MMIDs, but the figures for this month are again pretty dismal. The NPCI is taking other steps to promote…