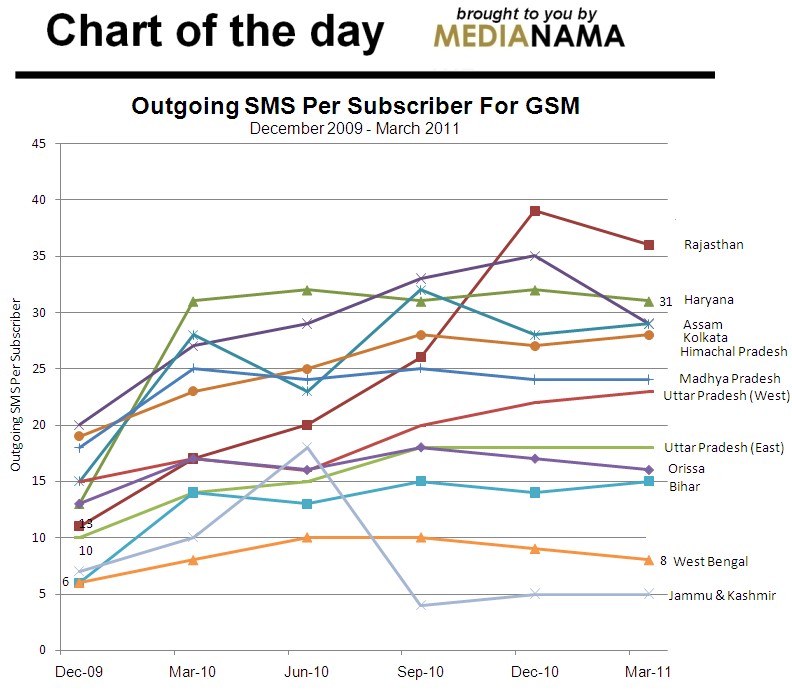

Update: we've replaced the chart below with two new charts, for better clarity on SMS performance per circle. As an aside, also look at outgoing SMS' per circle from the perspective of the penetration of the English language in that circle. If nothing else, these charts indicate highlight the fact that areas where there is perceived to be a larger English speaking population sends more SMS. Why handset manufacturers don't retail Indic language keypads and support Indic text is beyond us. P.s.: Thanks for the feedback Samir. Earlier: We had heard from industry sources that the outgoing SMS per subscriber in India could have been impacted by the growth of SMS Spam, and that telecom operators were pushing TRAI to implement stringent SMS Spam regulations, because consumer usage of SMS among consumers had declined. In part one of this series, we'll look at Outgoing SMS per subscriber for GSM, based on data provided by TRAI, and also look at circle-wise trends. The data suggests that for the quarters ending March 2010 and March 2011, the outogoing SMS per subscriber per month for GSM services increased by 15.72%, from 38 SMS to 44 minutes. However, sequentially, it by 3.22% from December 2010, when the GSM sector reported outgoing SMS of 46 SMS per subscriber per month. The Top 10 circles: Other circles Earlier chart | Data Source: TRAI Some observations: - Metro cities saw 48 outgoing SMS per subscriber per month while Circle A which includes Andhra Pradesh, Gujarat, Tamil Nadu (Including…