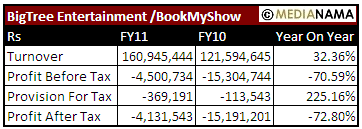

BigTree Entertainment, the Network18 subsidiary which owns the movie ticketing site Bookmyshow.com, reported revenues of Rs 16.09 crore for the year ended 31st March 2011 (FY11), up 32.36% from Rs 12.16 crore in FY10. Alongwith the growth in revenues, the company has reported a significant reduction in losses: compared with the Rs 1.52 crore loss in FY10, the company reported a loss of Rs 41.31 lakh for FY11. Network18, for the last few quarters, has been talking about 'strong revenue growth' for the company, and had said in the third quarter of that fiscal, BookMyShow had reported an EBITDA profit. Note that BookMyShow had to had to halt ticket sales in Andhra Pradesh following the state government's order earlier this year. Network18 Says There Is PE Interest In The Company On an earnings conference call for the quarter ended June 30th 2011 (Q1-FY12), Network18s Managing Director Raghav Bahl said that there is interest from Private Equity firms in the both BookMyShow and HomeShop18. Network18 owns 60% in the Big Tree Entertainment. The structuring of its acquisition in 2007, as per the Network18 Annual Report: On 1 March, 2007, Web Group ( part of TV18 group) had entered into a business purchase agreement with Big Tree Entertainment Private Limited (Big Tree) and the promoters of Big Tree to acquire 60% post issue equity share capital in Big Tree. The said share capital was acquired by way of subscription of 8,548 partly paid up equity shares issued by Big Tree and purchase of…