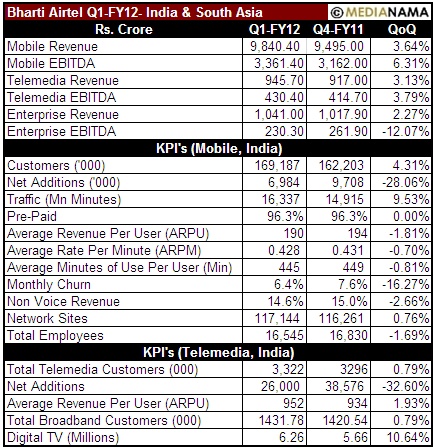

Airtel's non voice revenues (data, VAS, SMS) in India have declined to 14.6% of total revenues for the quarter, of the peak of 15% that was reported last year, despite a 3.64% growth in total mobile revenues, to Rs 9840.4 crore. MediaNama readers should keep in mind that in June, the company had issued new guidelines for subscription services, which would probably have impacted new sign-ups, if implemented. New guidelines are also being enforced by the Telecom Regulator TRAI, necessitating consumer confirmation of subscription by SMS, email or FAX; the impact of this regulation expected to be enforced this month, may be also impact revenues from non-voice in future. Financials Airtel reported consolidated total revenues of Rs 16,974.9 crore, up from Rs 16,293 crore last quarter, and a net profit of Rs 1215.2 crore, down from Rs 1400.7 crore last quarter. It reported an EBITDA of Rs 5705.8 crore, up from Rs 5483 crore. It's EBITDA margin was flat, marginally down to 33.6%, from 33.7%. In a statement, Airtel said that income before taxes dropped mainly on account of: higher interest outgo (Rs 344 crore) caused by the Africa acquisition and 3G investments in India, and 3G license fee amortization (Rs 159 crore). India & South Asia - Airtel reported a substantive 9.53% increase in mobile traffic, but this hasn't really been reflected in revenue, which grew 3.81%, which is par-for-course. There was a marginal decline in rate per minute, but that has now been addressed (in the current on-going), with a reported increase…