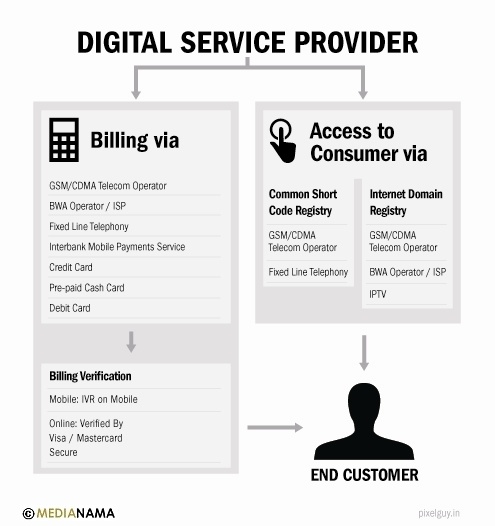

While mulling over the comments that MediaNama should submit in response to TRAI's questions for consultation on mobile Value Added Services (you should submit your comments independently as well), I was wondering about what should be an ideal scenario for a service provider and a consumer. At present, the mobile service delivery ecosystem operates in the form of mini monopolies: the access service provider owns both access to consumer and billing integration, and it is a collection of closed ecosystems. At the same time, the ideal, open access, open billing ecosystem is the Internet. So, given a choice, how should we rejig the ecosystem to provide more choice to the customer, and more options for both access and billing to the service provider? An independent Digital Service Provider should be able to provide services and content to the customer through multiple modes of access, and also provide her with multiple options of billing. In addition, given issues with reconciliation of accounts with access service providers, in my opinion, three key changes in the value chain are necessary: 1. Separate ownership of identity from provisioning of access: at present, short codes are owned by the access service providers on mobile. Resources for provisioning services are typically hosted with the access service provider, and not independently, like in case of servers for hosting websites. A common short code registry would work the same way as an Internet Domain Registry works - through a Domain Name System (DNS), point the short code to…