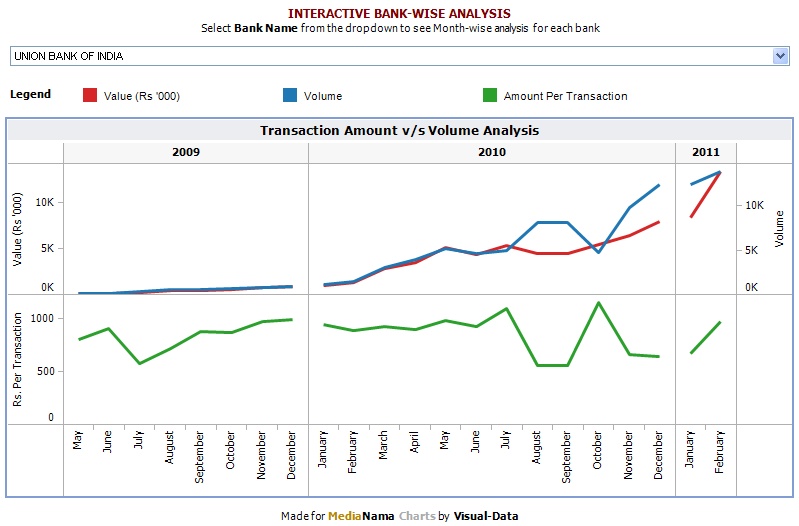

Nokia has started shipping mobile phones in India that are preloaded with the Obopay mobile banking applications, starting with the X1-01, a dual-SIM (subscriber identity module) phone manufactured from its Indian facility, reports PC World. The primary interface for mobile banking, the report suggests, will be SMS. Remember that Nokia has partnerships with Union Bank of India and Yes Bank; as a 'Banking Correspondent', registered Nokia stores will act facilitate service registration, money transfer and cash withdrawal. Nokia has a massive retail network across India. By embedding the Obopay application on its handsets, is probably hoping that this will help increase sign-ups and usage of mobile banking, by being the default payments application. Nokia has a majority share of the Indian handset market with hundreds of millions of handsets, but it will take a few years for consumers to replace their handset with an Obopay embedded one; meanwhile, Indian handset companies like Micromax, Lava, Karbonn, Lemon etc are eating into the lower end of the market, even as Android (Samsung, LG, HTC) and Apple have taken over the top end. The replacement cycle will, in all likelihood, not be kind to Nokia, and hence, to Obopay. Another factor to keep in mind is that Nokia's interface hasn't always been application friendly, though its approach is likely to change with newer handsets. Mobile Banking Struggles To Grow Mobile banking growth in India has been slow, and both Union Bank of India and Yes Bank have a fairly small share of even that small amount.…