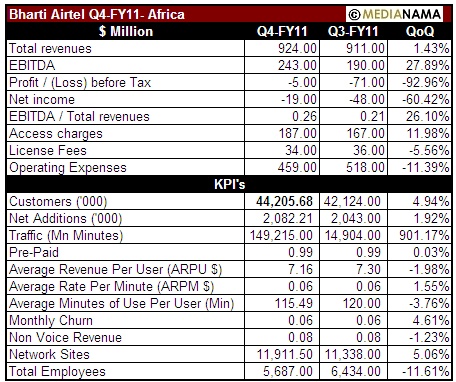

Airtel reported yesterday that the contribution of non-voice revenue (data, VAS, SMS) for the quarter, for its India mobile operations, was as high as 15%, probably the highest it has been over the last four years. It's not quite clear what has pushed revenue contribution up, since Airtel doesn't really have as much of a mobile data card services base like competitors Reliance Communications and Tata Indicom, and 3G services have only just been rolled out, and given the context that the company had switched off its Bulk SMS business (or claimed to have done it), 15% is rather high. Last month the company reported 2 million 3G customers in India; while the company has claimed to have launched 3G services launched in over 21 cities, there appears to have been an impact on network availability since the rollout - yesterday, there were reports of Airtel's network being down during the second half of the day, across its home circle of Delhi, with customers not able to send or receive calls; I faced a similar issue for an entire day a week or so ago. A map has even been set up for plotting network outages, based on tweets. If this continues, it doesn't augur well for "minutes of use" in the current quarter (the one we're in); Minutes of Use were flat quarter on quarter for March 2011, and both Average Revenue Per Minute (ARPM) and Average Revenue Per User (ARPU). Consolidated Revenues Airtel reported consolidated revenues (including operations…