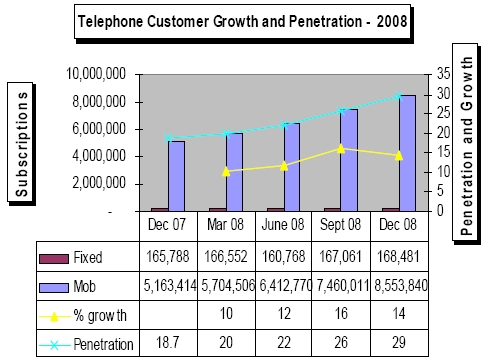

Essar Teleholdings, the telecom subsidiary of Mumbai-based Essar Global, has set up a 90:10 joint venture with a local firm Kenyan Telecom Uganda Ltd. The JV has received a licence to begin operations in Uganda. According to Mint, Essar will invest $200 million in the network and will launch in August this year. Uganda Telecom Market For pan-Africa Telecom Operator MTN, the Ugandan telecom market has one of the least ARPUs in South and East Africa at $7, compared to $13 in Nigeria and $11 in Swaziland, if you go by South African operator MTN's records. In comparison, Indian ARPUs have been falling - in the December quarter, GSM ARPU was Rs. 220 or $4.7, which is lower than African ARPU. Teledensity in Uganda was 29.47% and there were 8.55 million mobile connections as of December 2008, according to (report, PDF) the countrys Telecom Regulator Uganda Communications Commission, growing at 14% monthly. Teledensity is 39% now according to Pyramid Research. SMS is highly popular in the state with 190 million text messages sent in the December quarter. The telecom commission in Uganda has noted that infrastructure sharing is emerging as an economically viable option for new entrants. The other operators in the region are Uganda Telecom, Zain Telecom (which has been setting its sights on India), Abu Dhabi-based Warid Telecom and France Telecom's Orange Uganda. Orange Uganda launched in March 2009 and has around 57,000 mobile connections in Uganda, and France Telecom has an overall base of 42.6 million in the…