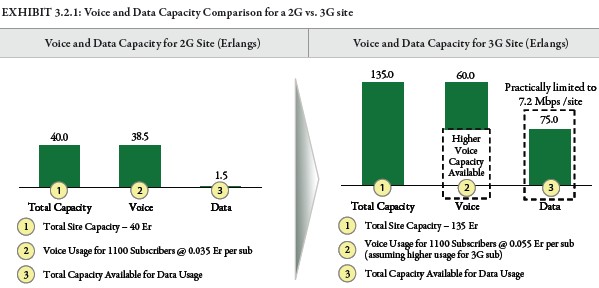

Many VAS and Teleco executives have told us over the past 3-4 months that 3G, whenever it is launched, will primarily be about voice. The hypothesis has been, in most instances, based on the fact that existing operators like Airtel and Vodafone are desperate for spectrum for voice services; if you're an Airtel subscriber in Delhi like me, almost every call gets dropped. A report on 3G and Broadband Wireless Access by BDA and FICCI challenges that hypothesis as follows: 1. High End Customers Contribute Higher Margins: At present, the top 9% of mobile subscribers contribute to around 29% of circle revenues, and 45% of margins. Given that over 10 million subscribers in India already have 3G enabled handsets, and there are almost 1.5 million data card subscribers - these subscribers will be the early targets for migration to 3G. So in order to migrate users to 3G, the operators are likely to offer good voice quality, bundled or subsidized high-end handsets, and high-touch customer service. The growth in ARPU in case of 3G services is likely to be limited to access, internet browsing, messaging and email, which a majority of the revenue coming from access charges. 3G data plans will be comparable to DSL offerings, with flat rates and speed based plans offered after the first few years. BDA also expects voice-data bunding for users with fixed rate, unlimited voice plans in later years. Download the report here 2. Voice & Data Capacity: according to BDAs analysis a 3G cell…