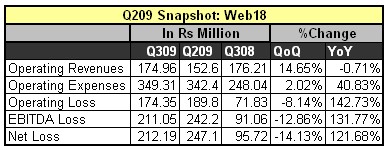

Well that was quick: we asked two days ago about when and where Web18 would go in for a listing, and late in the evening yesterday, we got our answer to "where" - NASDAQ. In a TV18 results filing with the Bombay Stock Exchange, the company announced that they had submitted, on a confidential basis to the USAs Securities and Exchange Commission, a draft registration statement for a proposed IPO of American Depositary Shares. When we had spoken to Surya Mantha, CEO of Web18 a couple of days ago, he had declined to comment on potential listing plans. Sources had told us that he was in the US earlier in the quarter, possibly for initiating the listing process. The date for the IPO has not been finalized, and the company will look at it when market conditions permit. The number and dollar amount of ADS proposed to be offered and sold have also not yet been determined. This also explains the ESOPS that were handed out to senior employees recently, which we had reported earlier this week. [poll id="7"] P.s.: Do tell us why or why not (no slanderous comments, though) Q3 Results Another quarter of losses for Web18, as the operating expenses increased quarter on quarter, and at Rs. 349.31 million, were almost 41% higher than the same quarter in 2008, and almost the same as last quarter. Revenues remained flat year-on-year, and grew by around 15% quarter on quarter. Unless Web18 does something about its increasing expenses, this looks…