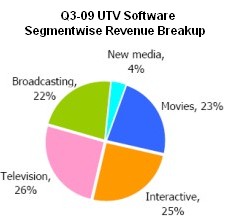

UTV Softwares Interactive and Gaming segments appear to have turned a corner - for the quarter ending December 31st, both divisions have reported a profit at the EBITDA level. On revenues of Rs. 346.01 million, the gaming division has reported an EBITDA of Rs. 12.23 million, while the New Media segment has reported an EBITDA of Rs. 1.405 million, compared to an EBITDA loss of Rs. 21.7 million last quarter. However, for the 9 months ending December 31st 2008, both segments have reported an EBITDA loss. Ronnie Screwvala, Founder and CEO of UTV Software, has said that the company will remain in investment mode this year, and deems it unfair to judge the company on the basis of net profit margins since they are still focusing on building scale, saying that "operational efficiency will come into place once we have demonstrated growth." The investments in the gaming segment continue to dwarf the investment in the New Media business. Over the last 9 months, UTV has invested Rs. 1.6 billion in the Games Content segment, including Indiagames and Ignition Entertainment. This division has contributed 25% to the companys operating revenues in the last quarter. IndiaGames: has grown around 20% quarter on quarter, with most of its growth from its India operations; the company has diversified its revenue concentration across telcos in India and has entered some strategic distribution relationships internationally to further growth in the US and EMEA (Europe Middle East & Africa) regions. A restructuring of the development team also resulted in…