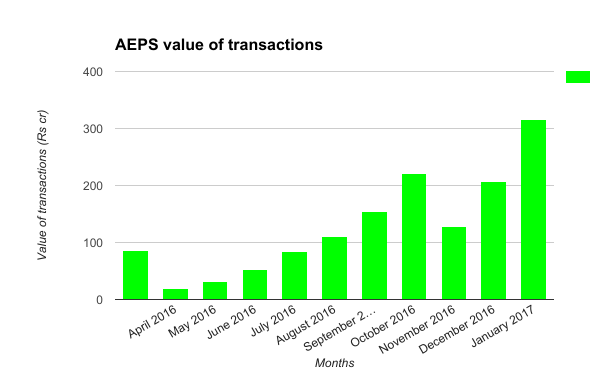

The number of financial transactions of the Aadhaar Enabled Payment System (AEPS) for the month of January 2017 stood at 2.65 million and the value of these transactions stood at Rs 316 crore, National Payments Corporation of India data showed. In December 2016, the number of financial transactions on the AEPS stood at 1.97 million with a value of Rs 207 crore. Financial transactions include cash withdrawal and cash deposits. The number of transactions on the payment system grew sharply following the demonetization of Rs 500 and Rs 1000 notes. To give context, the volume of transactions on the AEPS for the financial year 2015-16 was 0.36 million with the value of transactions at Rs 86 crore. Note that in January government had claimed that "more than 33.87 crore transactions have taken place through AEPS, which was only 46 lakhs in May 2014." The AEPS is a financial inclusion product developed by the NPCI which allows cash withdrawal, deposit and funds transfer at POS (Micro ATM) through a business correspondent of any bank using the Aadhaar authentication. So far, there are 119 banks on the AEPS. Most recently, Spice Money, the domestic remittance service from Spice Digital, got permission from the NPCI to process payments over the AEPS. The AEPS also allows a number of non-financial transactions such as balance enquiry and mini statements. For January 2017, the number stood at 1.6 million. A reminder: So far there are three other payment infrastructures which are linked or will be liked to the Aadhaar: – First is…