Startups position their product using too many sophisticated words. Ask ur customers and listen to their description. Use words that matter.

— Shekhar Kirani (@skirani) November 22, 2016

It is common knowledge that Indian engineers, in general, have great expertise in building products. But on the other hand, they have little appreciation of the importance of building a compelling story highlighting why customers should “care” about these products. They don’t understand how their customers speak and sometimes they don’t care. It isn’t tough to find engineers building stuff without any idea of who it is for or why.

While one can expect the average Indian startup to suffer from this blind spot, it is a surprise that a high-profile solution like the UPI seems to have been afflicted with the same curse.

A quick introduction to UPI

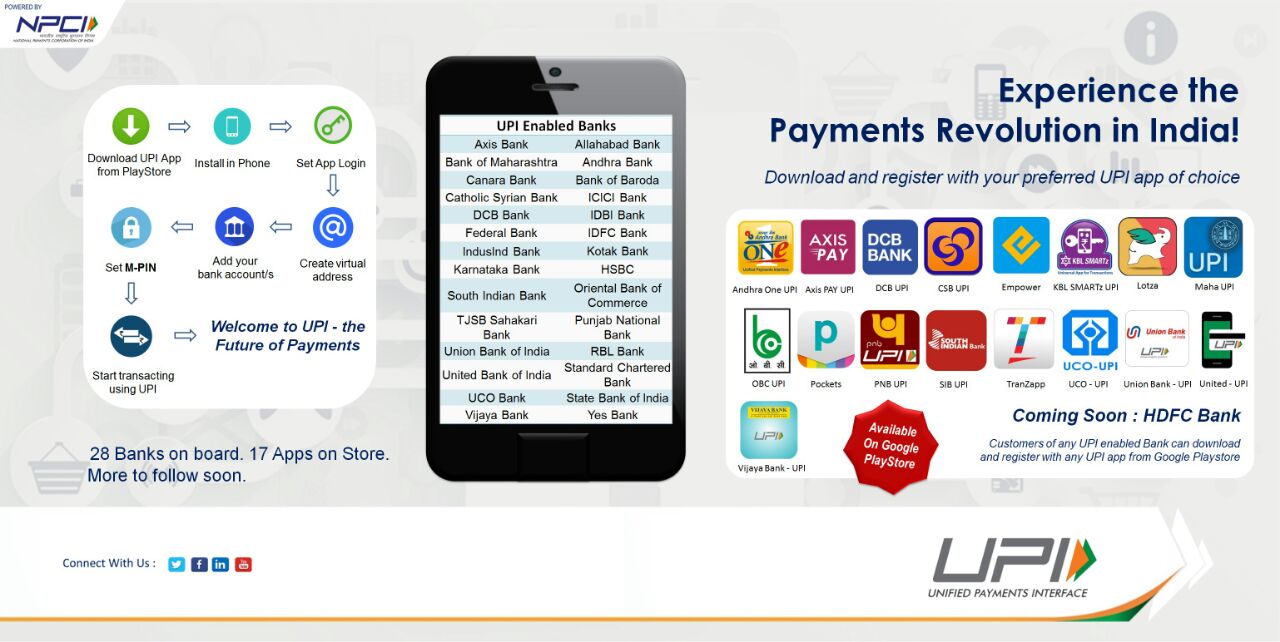

UPI stands for United Payment Interface and facilitates real-time sending and receiving money through a mobile application. The interface is ostensibly a more user-friendly version of IMPS, a 24×7 funds transfer service provided by banks in India. UPI is stewarded by National Payments Corporation of India (NPCI) – the umbrella organisation for all retail payments systems in India. As of today, there are a total of 30 banks which have UPI-enabled mobile apps on Google Play Store.

UPI’s narrative problem

I was fortunate enough to attend one of the conferences where NPCI was launching UPI. The pitch at that time was that wallets were going to be disrupted by UPI’s technology.

Disrupting wallets?

I could immediately hear blaring alarm bells go off in my head.

Many users like me use wallets for their convenience value and not because of their underlying technology. If an app is usable, users will definitely use it. If not, users will continue to use wallets. Consumers don’t care what your technology is or what stack it is part of or what servers you are on. They only care if your app works or not.

A common person will continue to use something which he feels comfortable. Does he care about what is running in the backend, UPI, API, Javascript, Jquery, etc? And the UPI is not exactly consumer tech. Which means that in their communications/campaigns, NPCI should ideally be communicating to the developers. But of course, they aren’t. They are talking about replacing wallets when they should be talking about something else entirely.

I’m going to put my hand up and disagree with the UPI team and I feel good designed/usable wallets are here to stay. UPI is a feature and will remain one in mobile banking apps.

In my opinion, UPI also has a “name problem” – this acronym might sound nice to an engineer but conveys nothing about what it aims to offer. Equally, there has been a failure of communicating to its target users about how it can add value.

UPI is an infrastructure platform and not a B2C product, but the positioning is that of a B2C product. If they want to a consumer product, they should have used a different brand. In fact, they should have a brand for Merchants (think something like Intel Inside), Developer Brand.

Rather than comparing itself to wallets, UPI should have clearly communicated that it is not a consumer product but merely an infrastructure or enabler for making payments that anyone can use.

UPI’s UX (user experience) problem

In a recent meeting, I heard that 2 million users (in less than 2 months) had signed up for UPI. This is certainly an impressive number. But to my question about how many users were really using UPI, I didn’t get a response. It seemed very likely that the adoption was low. I want to be an early adopter for products. I had registered for UPI, got a virtual payment address, but had no clue what to do after that. Simply because I don’t know who else is on UPI.

Compare this experience with WhatsApp?

Did you ever face this problem after signing on to Whatsapp? Did you have to find out who else is on WhatsApp so you could send a message to them?

Therefore, this is just a poorly designed experience.

I want to point out some more aspects of UPI which are badly designed and may be the reason for its low adoption.

- Although the UPI team claims to be like a TCP/IP stack which will remain in the backend, all its communications on social media are trying to show how easily a consumer can use UPI. I don’t know how that makes sense. Shouldn’t the communications be about how developers/banks can build on top of UPI and create value.

- UPI doesn’t exist on iOS, but most of the early adopters are on iOS, and this would have been a great way to give feedback on the platform. They’ve lost this chance to be relevant

- UPI could have made a smart logo like VISA/MasterCard/Paytm have, saying something like Enabled/Powered by UPI. They’ve lost a chance to create a brand.

- Every bank has its own address. How will a consumer remember all of it? If it was unified, why not a unified address like name.lastname@upi ? Why couldn’t it be mapped with your mobile number.?

- This was a recent ad promoted on Twitter which was more like a push towards getting more consumers. Even by that standard, it’s confusing:

First, if you search for UPI on Playstore, you get 20 apps, you really don’t know which one to download, as these are all apps from the banks.

- It tells you to register for Virtual address, which I have no clue about. What does that even mean? (By giving an example it would have simplified the process).

- I had registered for UPI on my ICICI bank but had no idea what to do after. How do I come make the payment to the other guy who has a UPI address? How do I find out who uses UPI?

- Have you ever see someone promoting TCP/IP by saying that you can browse the web, send files and access emails? That is exactly what is happening.

Demonetisation – a missed opportunity?

In the last couple of days, I saw UPI going very active on social media and claiming that they had a solution for demonetisation. The idea they were trying to communicate was that if you are on UPI, you can even withdraw cash and deposit cash.

Nope, you can’t.

Saying UPI will kill wallets is like saying TCP/IP will kill Google.

And I shouldn’t have to explain the number of levels on which the above statement is frivolous.

Can UPI be the WhatsApp for Payments?

UPI’s real opportunity is to be the “WhatsApp for Payments” – a seamless, user-friendly way to send and receive money as easily as one sends a WhatsApp message to a friend or contact. While there is no doubt that UPI has largely missed capitalizing on the demonetisation “perfect storm” and has allowed companies like Paytm to steal the thunder, all is not lost yet. With a few considered, informed and well-thought tweaks in the solution positioning and product user experience, UPI can still emerge as a meaningful channel in the cashless future that many Indians are now envisaging.

I, for one, remain hopeful that UPI will be able to ride this black swan and hope that its stewards recognize and fix the problems that stand in the way of UPI realizing its full potential.

Disclaimer: These are my personal thoughts and not in any way my organisation’s views. In no way am I challenging the technology and stack behind the platform. It is just with how the platform is communicating to the users that I have a problem 🙁

**

About the author: Avinash Raghava – an organization dedicated to the development of the Software Product Startups ecosystem in India

and a Fellow of iSPIRT.

Crossposted with permission from the author. Original post can be read here.