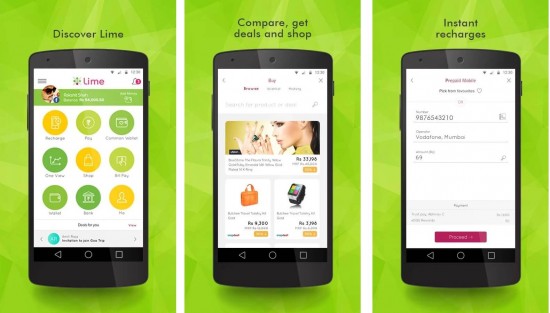

India's third largest private sector lender Axis Bank has launched a new mobile app called Lime which integrates a mobile wallet, shopping, payments and banking. The new app is open to customers from other banks as well. Note that this app is only available for Android devices at the moment. As a wallet, Lime allows users to load money from their debit and credit cards and through net banking. The wallet will have a four digit mPIN as authentication. The application also has a shared wallet feature where multiple users can access it and withdraw from it. It also has a pool money function where users can put funds in a shared wallet for a particular puspose and can be refunded later equally or in proportion. The app also allows users to compare and shop for products across online shopping portals within the app itself. Users can also book flights, buses and movie tickets. The app can handle proximity payments at offline merchants through a combination of sound and Bluetooth frequencies, (we'd first seen this with iKaaz's MOWA terminal which could handle proximity payments without NFC), although we're thinking that this would require an extensive roll out of terminals which can accept these payments. Rajiv Anand, head of retail banking at Axis Bank, also mentioned that the app will have a floating buy-via-Lime button while shopping on other shopping apps and websites. On choosing the option, users will be redirected to Lime Pay which can enable one-touch and secure payments from…