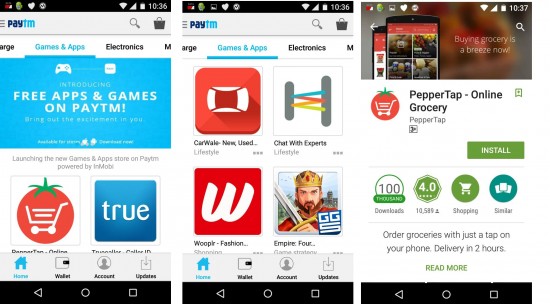

Update: In addition, Paytm informs us that their initial note had mistakenly called the section an app store. They're right: it's more of an affiliate section, and not an app store within an app. We should have been more vigilant. Update: Paytm's vice president for business, Dushyant Saraswat, spoke to MediaNama about the app section and hinted how in the next avatar it could be a bigger brand engagement platform to drive up app installs and offer consumers Paytm cash as rewards. "This is the first baby step in the direction of what we want to build as a fun category for our consumers. We intend to have fun elements out there in partnership with our brands etc where we will be able to generate great amount of engagement with the brand and do everything from app installs to education of the consumers about brands and services in future," he added. Earlier: Mobile commerce marketplace and digital wallet Paytm has now launched an "app store" on its mobile application in association with mobile ad network InMobi. This was first reported by The Economic Times*. However it needs to be pointed that the applications featured on Paytm are just hyperlinks back to the app on Apple iTunes or Google Play. We're not sure of future plans but we've reached out to Paytm and will update once we hear back from them. NextBigWhat also points out that this app store is primarily focused on getting a slice of the app download dollars being spent by the well funded startups. Note that Paytm, InMobi and…