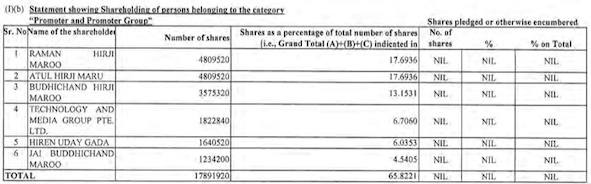

Bollywood content aggregation company Shemaroo Entertainment opened for trading on the Bombay Stock Exchange at Rs 180, up 5.88% from its offer price of Rs 170. At the time of writing this post, it was trading at Rs 171, a marginal 0.6% higher than its offer price. The shares so far has reached a peak of Rs 181 and a low of Rs 171, which is still higher than the offer price. The company currently has a free float market cap of Rs 92.96 crore and a total market cap of Rs 464.82 crore. Shemaroo closed its IPO subscription on September 18, 2014, with bids being subscribed 7.26 times over, as per Moneycontrol. Retail category was subscribed 7.5 times, while high net individuals category was subscribed 8.64 times and qualified institutional buyers (QIBs) category was subscribed 5.7 times. Earlier this week, the company fixed the issue price at Rs 170, with a Rs 17 discount to retail investors. Shemaroo had also sold 2.12 million shares (2,117,605 shares) at Rs 170 to anchor investors for Rs 36 crores on September 15, 2014, before the IPO opened. Investors mostly included funds from HDFC and Birla Sun Life, with HDFC picking up around 55%, and Birla Sun Life picking up the remaining 45% of that issue. Following this offering, promoters have reduced their stake in the company from 90.2% to 65.8%. Shemaroo Financials Shemaroo’s consolidated total income was at Rs 265.95 crore in FY14, up 23.1% year-on-year (YoY). The profit after tax was at Rs 27.27 crore in FY14, up 16.3% YoY while EBITDA was at Rs…