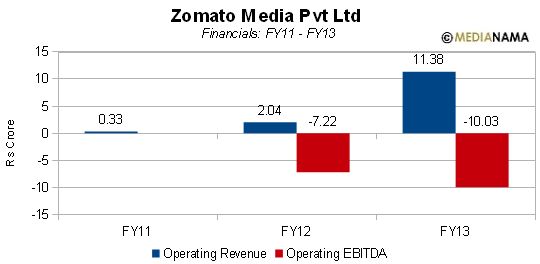

Zomato Media Pvt Ltd, which owns the restaurant search and review site Zomato.com, reported revenues of Rs 11.38 crore and an EBITDA loss of Rs 10.03 crore for financial year ended 31st March 2013 (FY13). Revenues for the startup grew 457.84 percent, by around Rs 9.34 crore from Rs 2.04 crore in FY12, even as its EBITDA loss increased 38.92%, by only Rs 2.81 crore from Rs 7.22 crore in FY12. Info Edge (Naukri) now owns a majority 57.9% stake in Zomato, having placed a significant bet of Rs 86 crore on the company in four rounds of funding. The company has also recently expanded operations to SouthAfrica, launching a site for Johannesburg. These are early days for Zomato, and the company had said that it broke even at an EBITDA level in the Indian market during the quarter ending December 2012, and in Dubai in the following quarter. What is probably leading to an increase in losses at an EBITDA level is its rather aggressive international expansion: apart from India, it has launched operations in Sri Lanka, United Kingdom, UAE, Qatar, South Africa and Philippines; Zomato has plans to launch in Thailand, and also has an eye on developed markets such as Canada, United States and Australia. The company had also launched in Singapore last year, however it decided to pull out few months later, since restaurants were not willing to share menus, and it was taking a lot of time to collect data compared to other markets. Zomato offers mobile apps for iOS, Android, BlackBerry, Blackberry 10, Windows Phone and Windows 8.